Small Business Tax Essentials: 2025 Edition

The 2025 Small Business Tax Essentials is a comprehensive resource tailored to help business owners confidently navigate the complexities of small business taxes. This material highlights your expertise in ensuring compliance with IRS regulations while helping businesses avoid penalties and maximize savings.

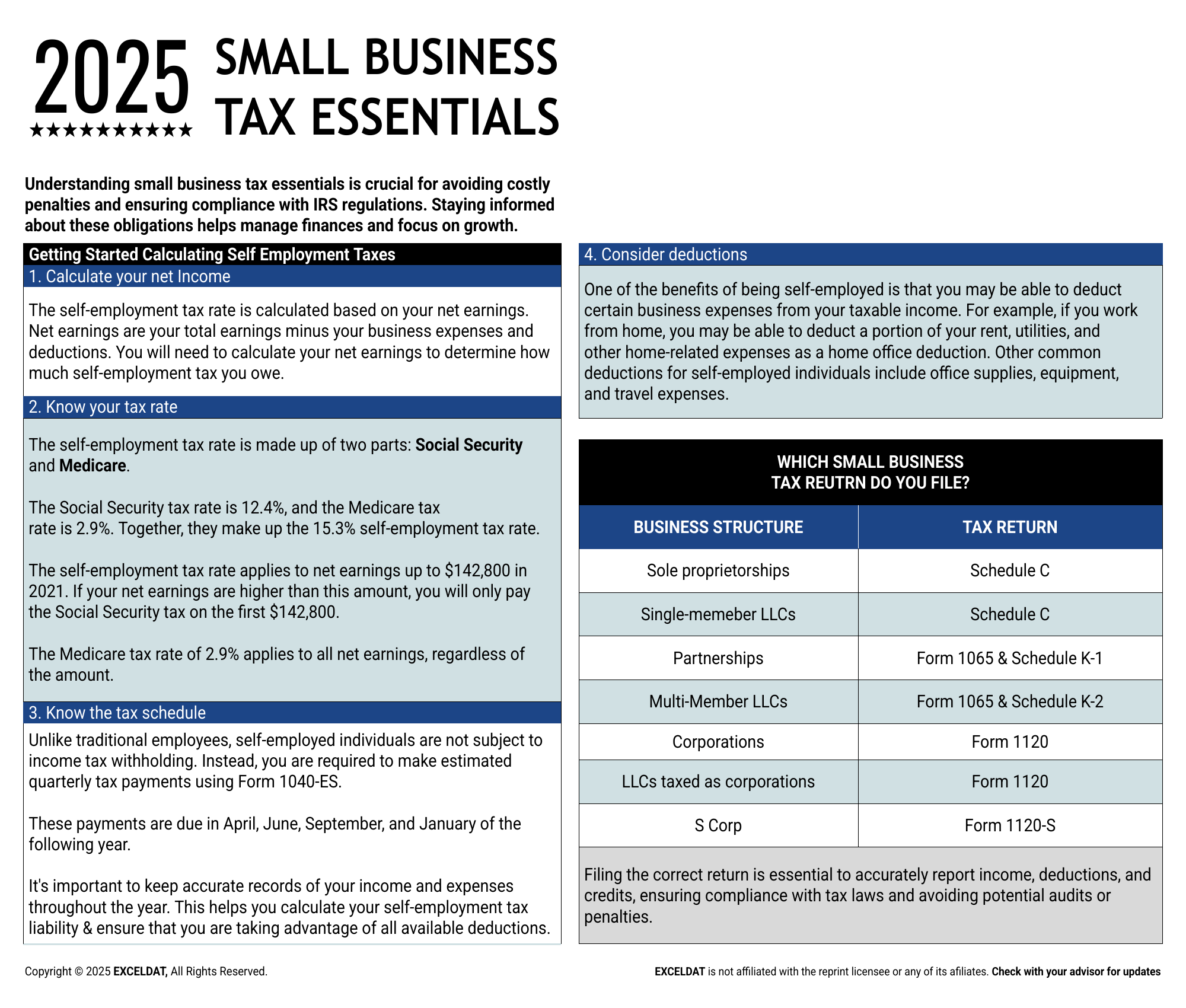

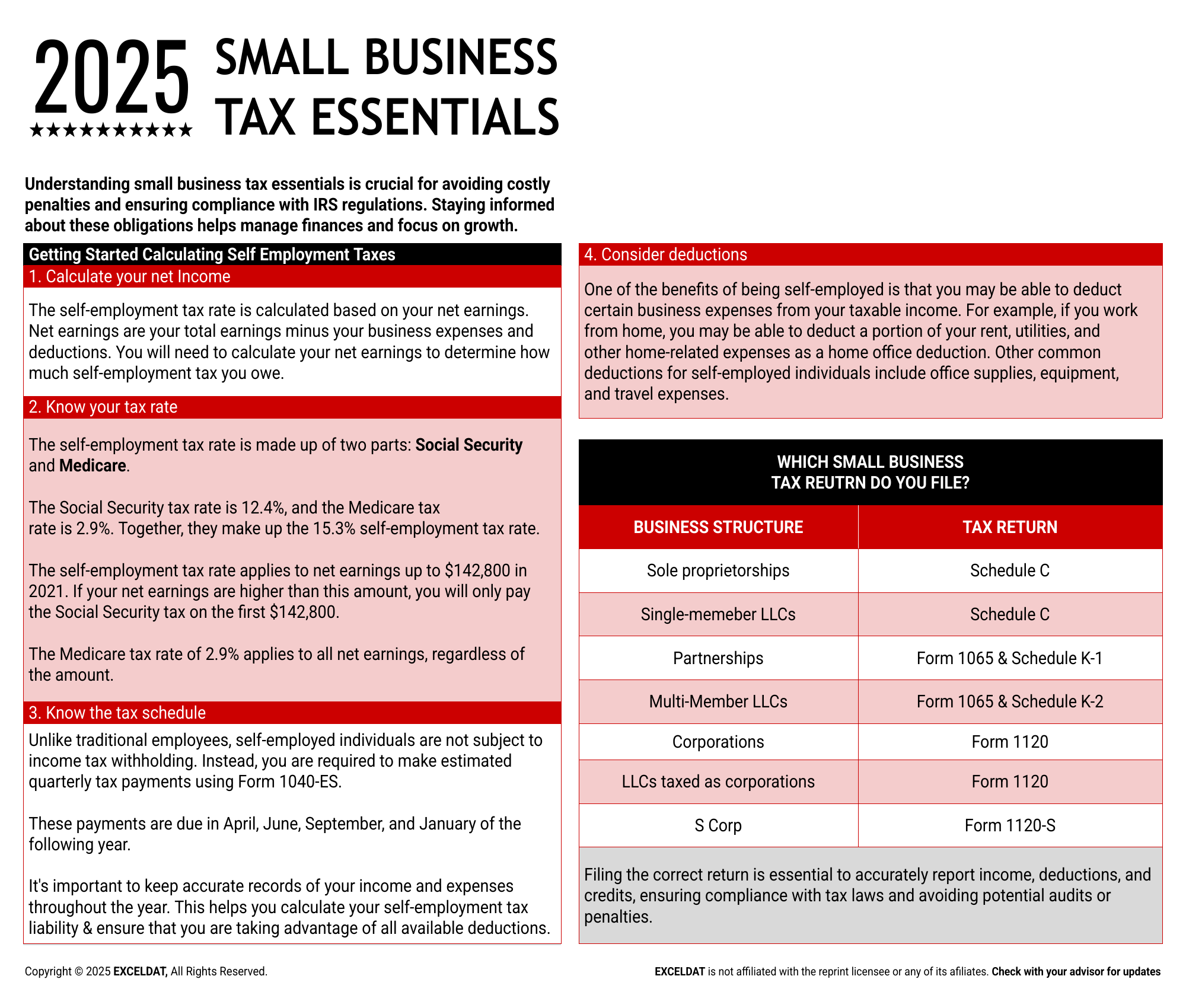

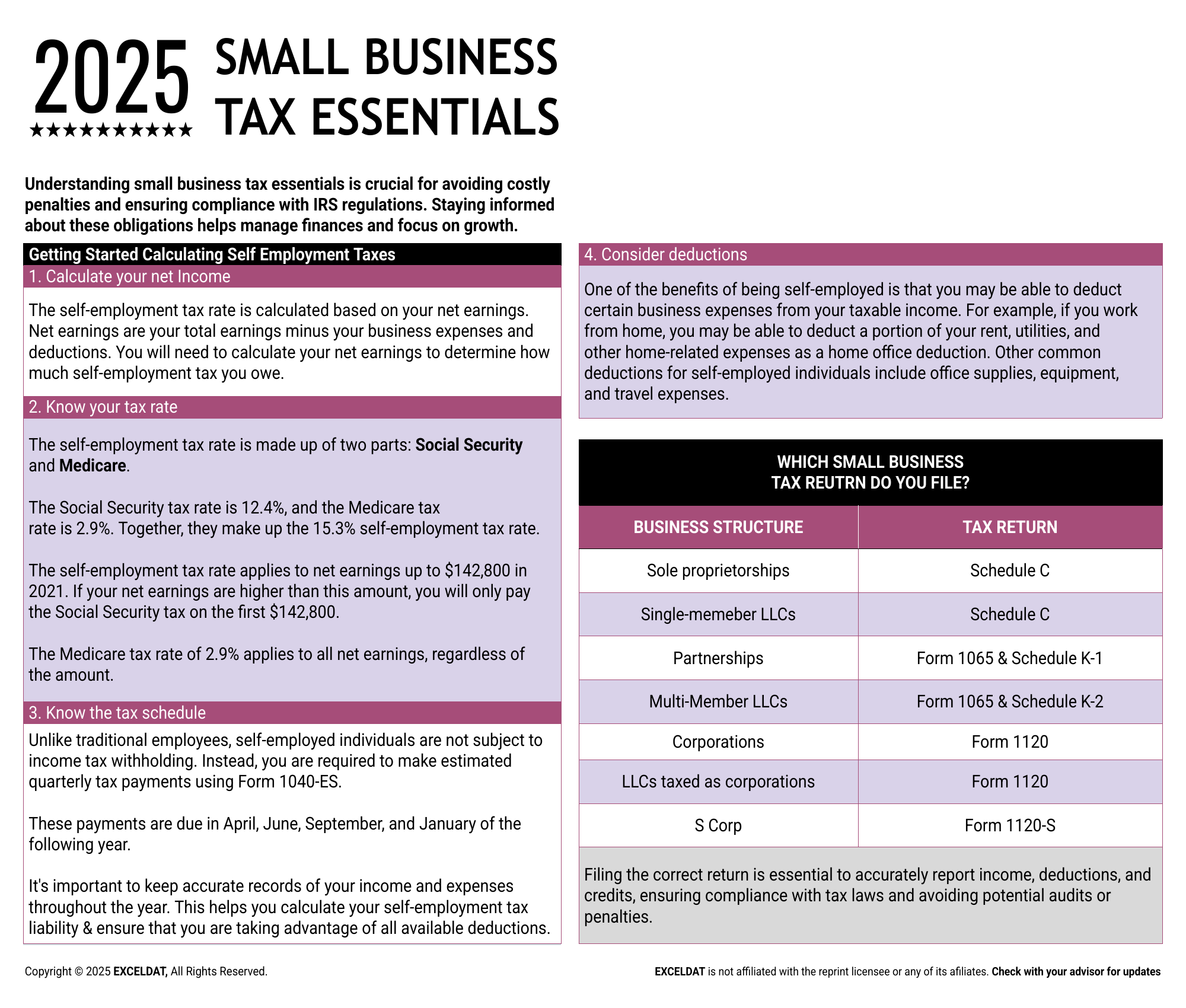

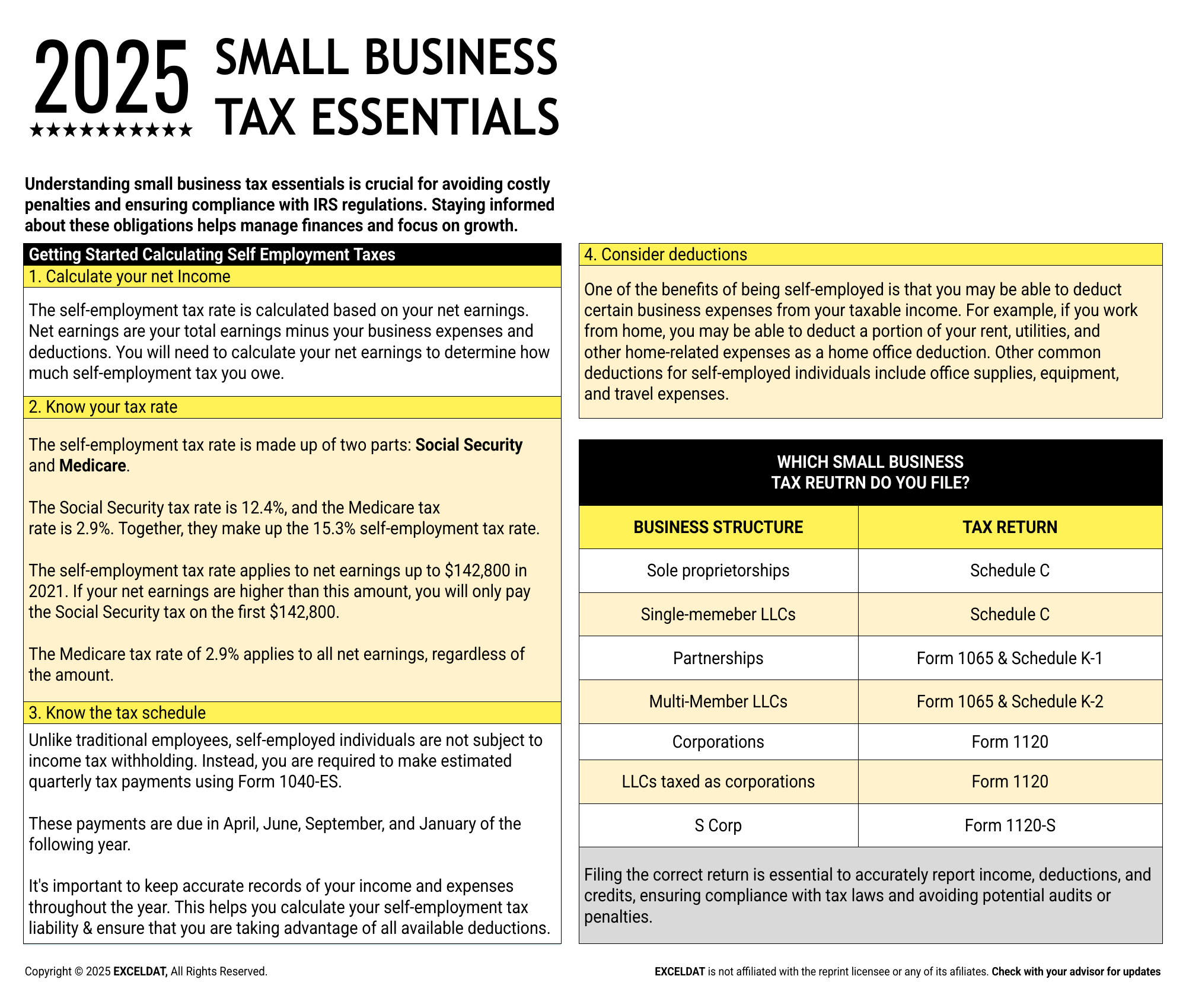

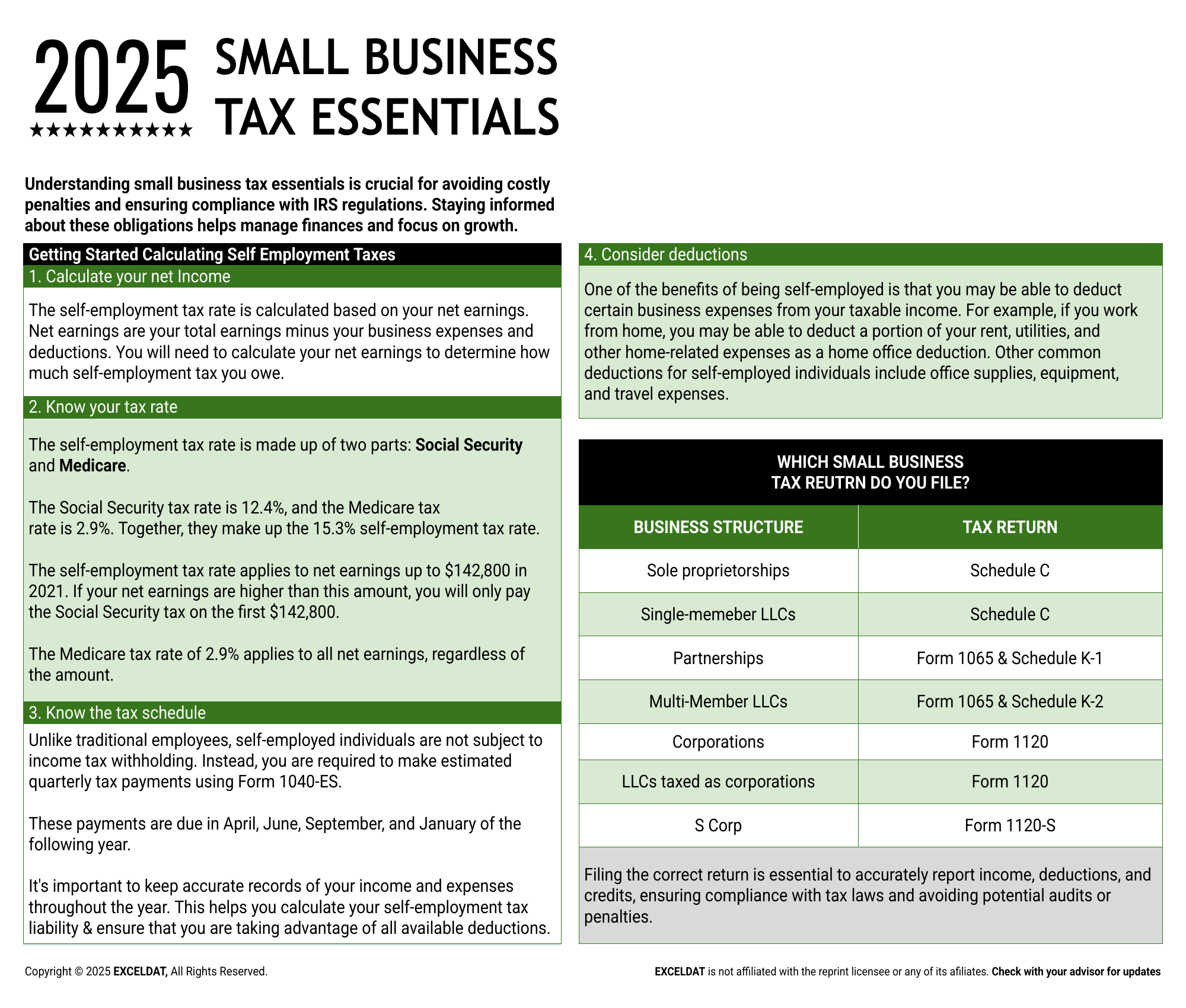

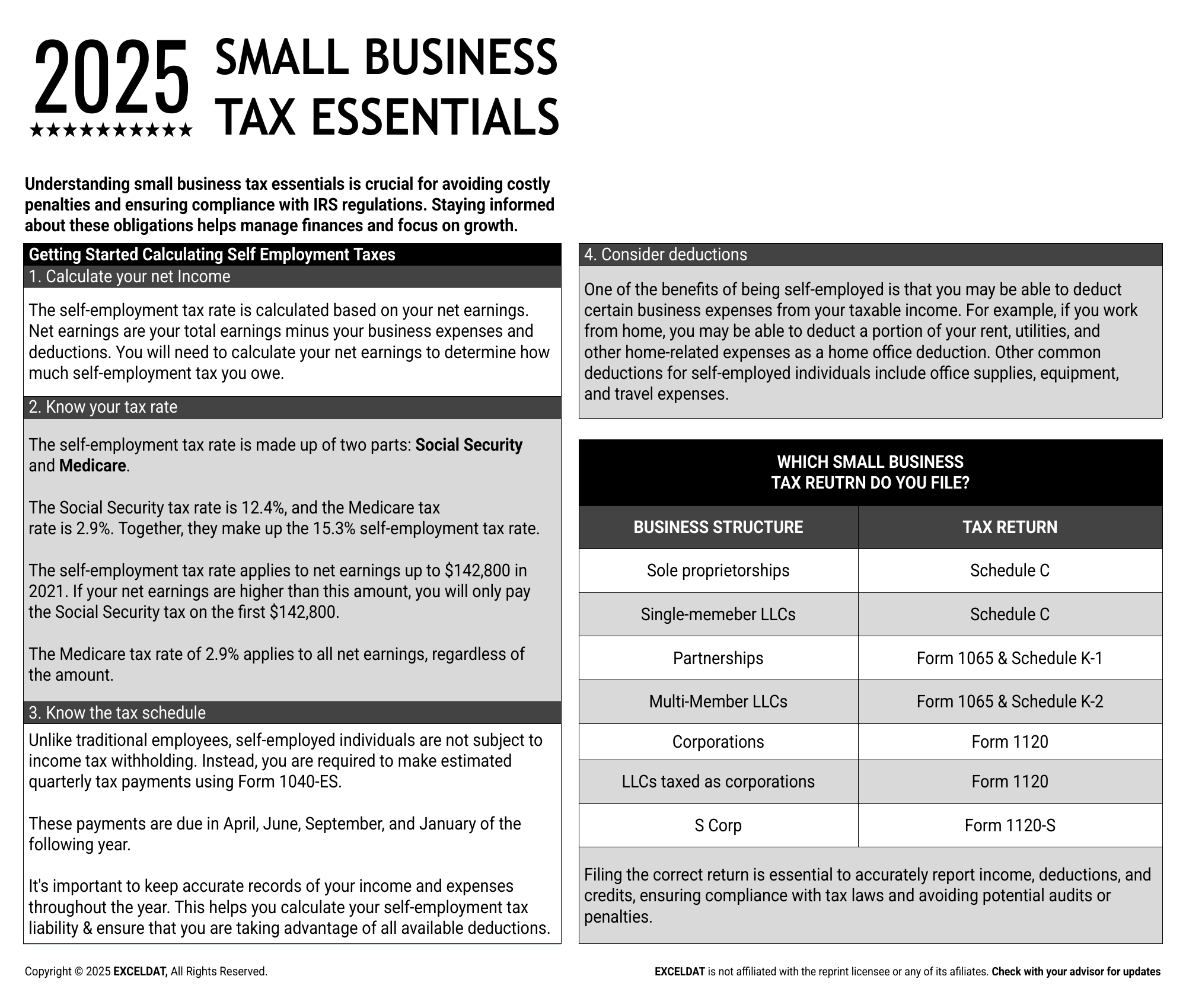

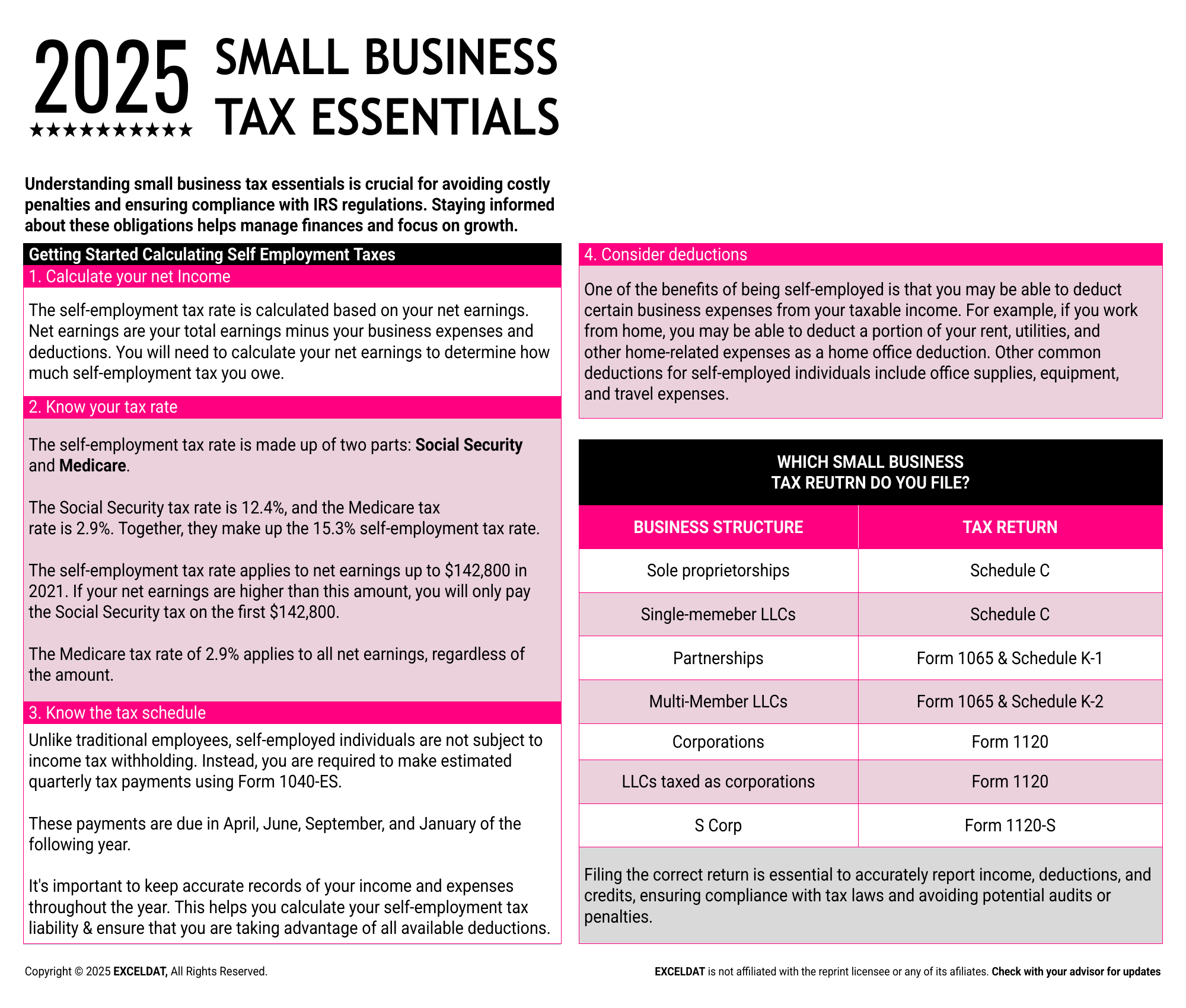

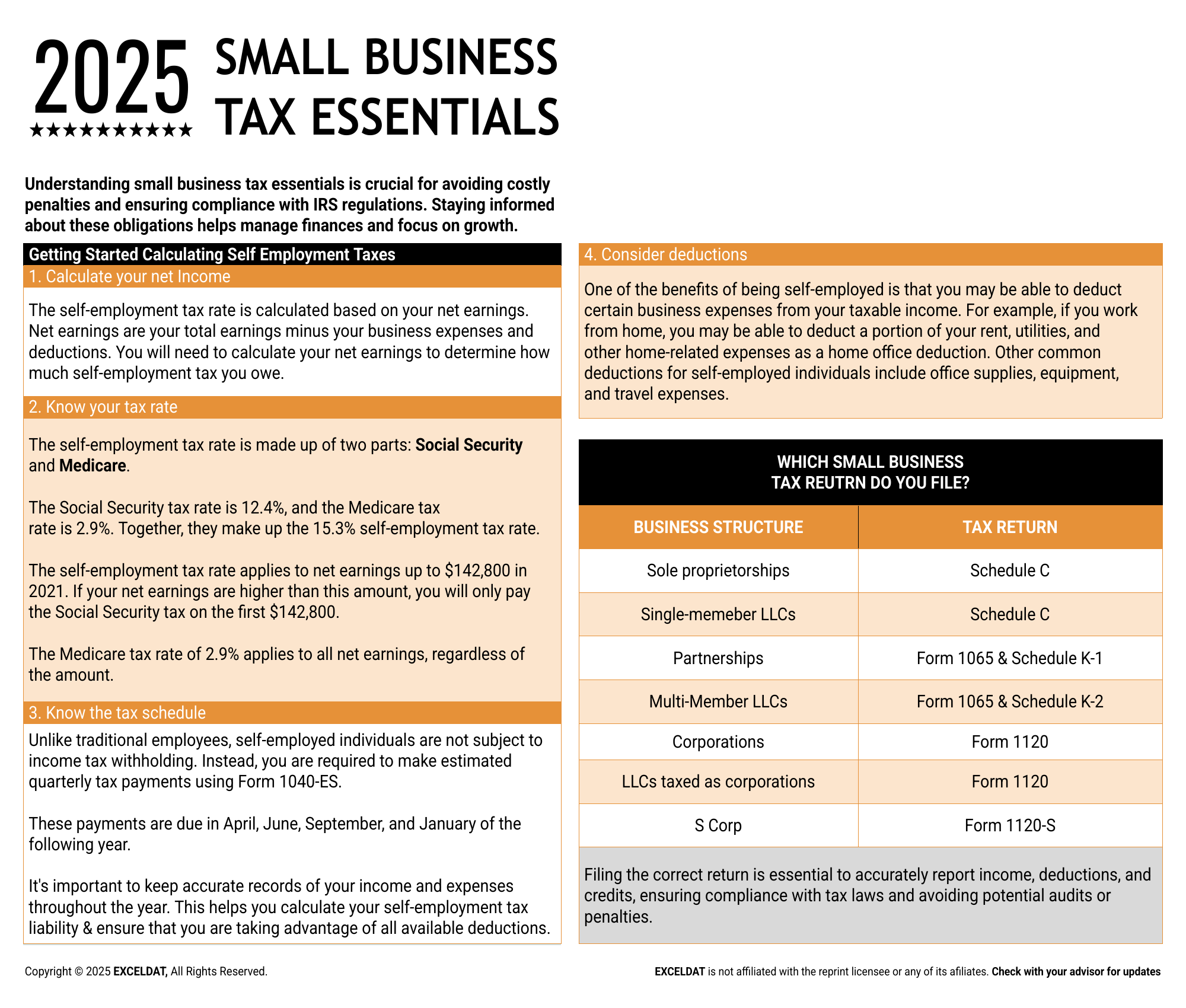

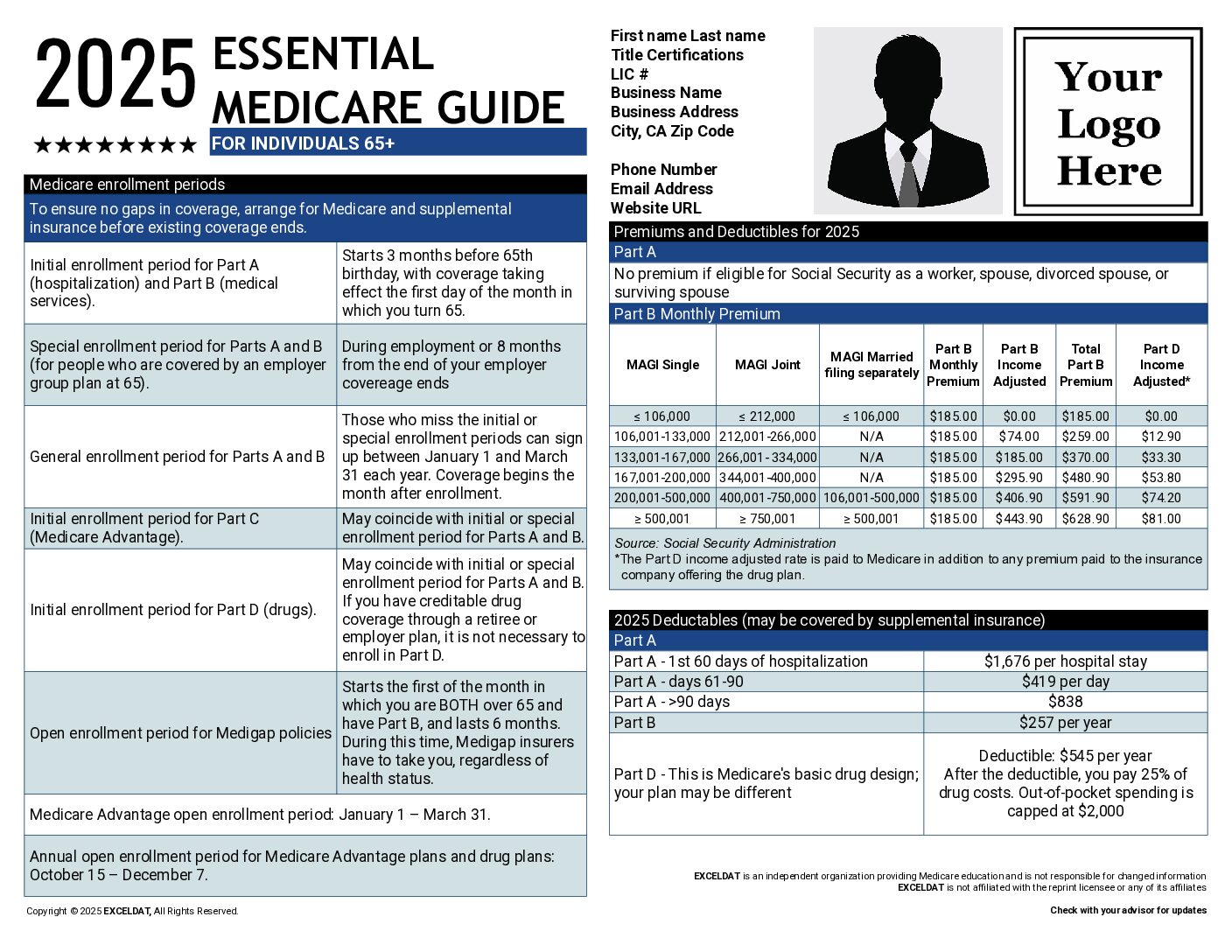

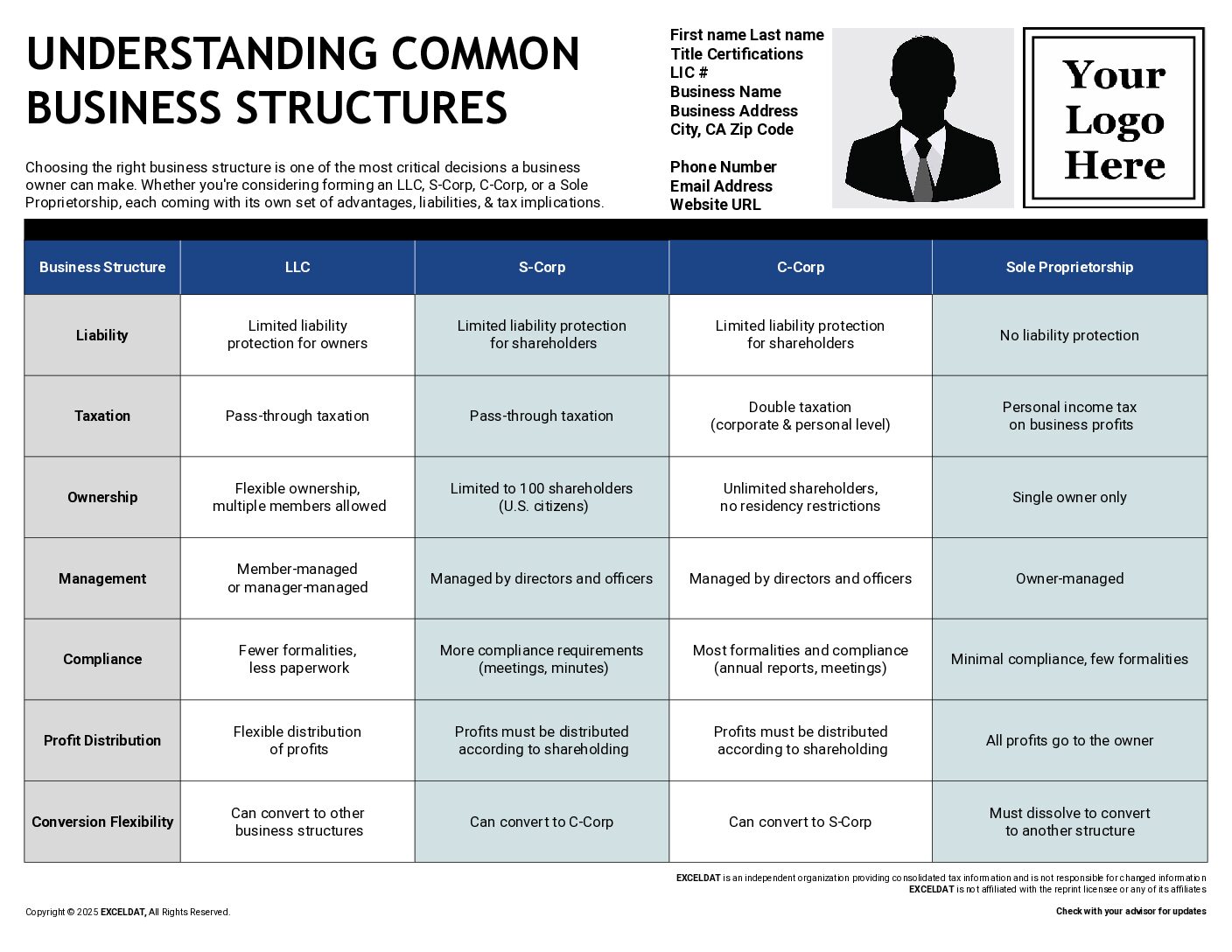

Overview of Business Structures & Tax Obligations

Overview of Business Structures & Tax Obligations

- Explains how different structures (sole proprietorships, LLCs, partnerships, S-corps, C-corps) impact:

- Tax filing requirements.

- Applicable tax rates.

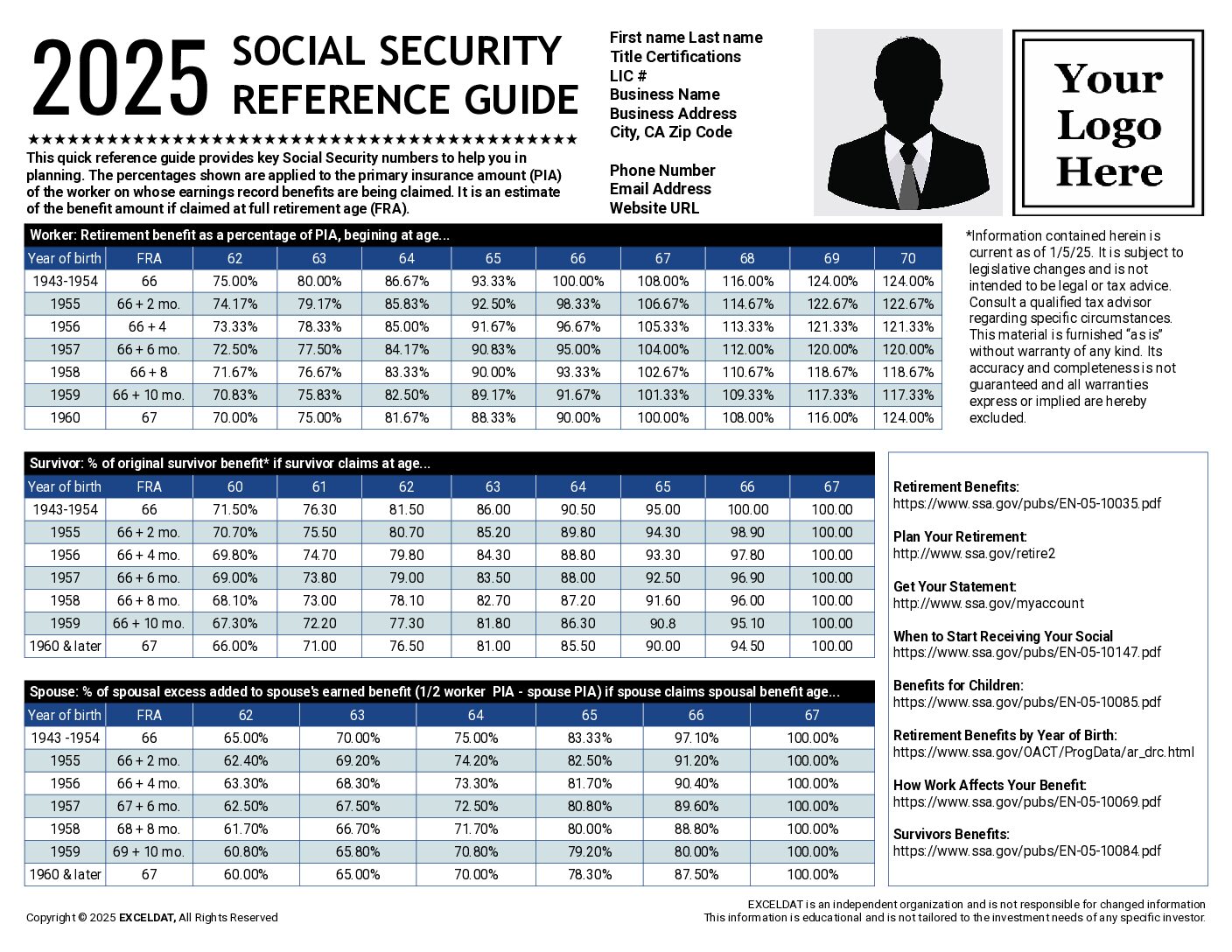

Self-Employment Tax Guide

Self-Employment Tax Guide

- Provides a clear breakdown of self-employment taxes, including:

- Calculating taxes for Social Security and Medicare.

- Understanding relevant tax rates.

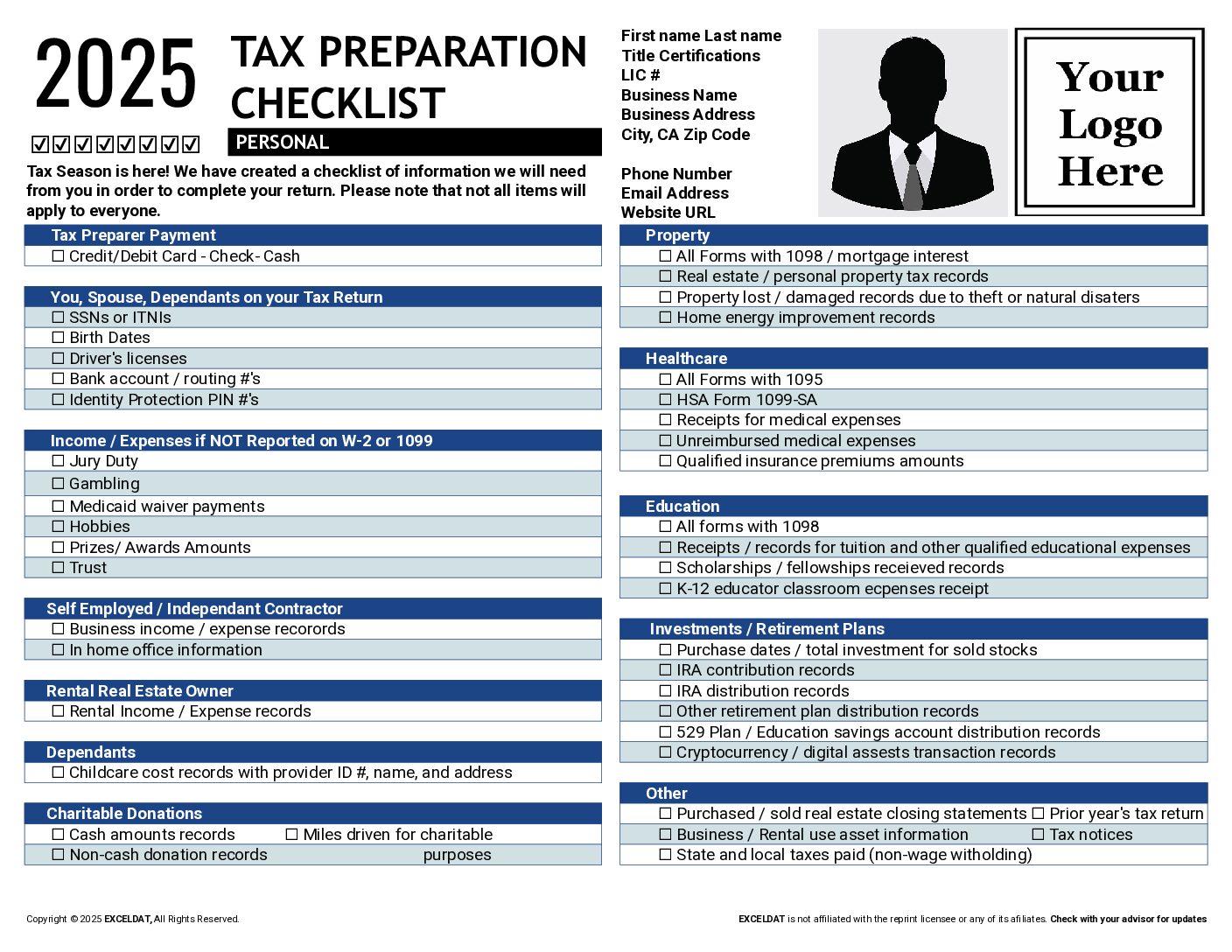

Deductions for Self-Employed Individuals

Deductions for Self-Employed Individuals

- Outlines common deductions to reduce taxable income:

- Home office expenses.

- Office supplies and equipment.

- Travel and business-related costs.

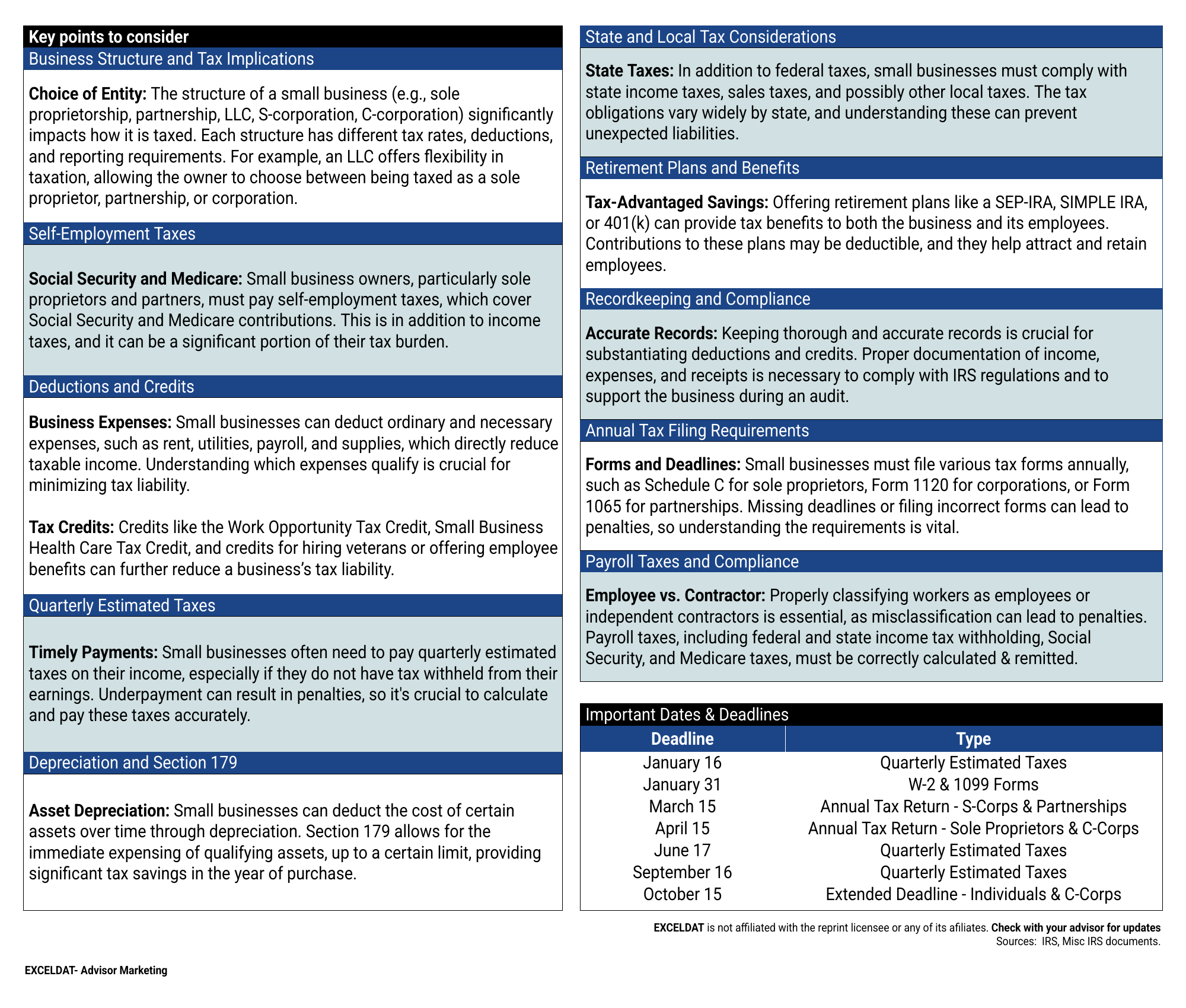

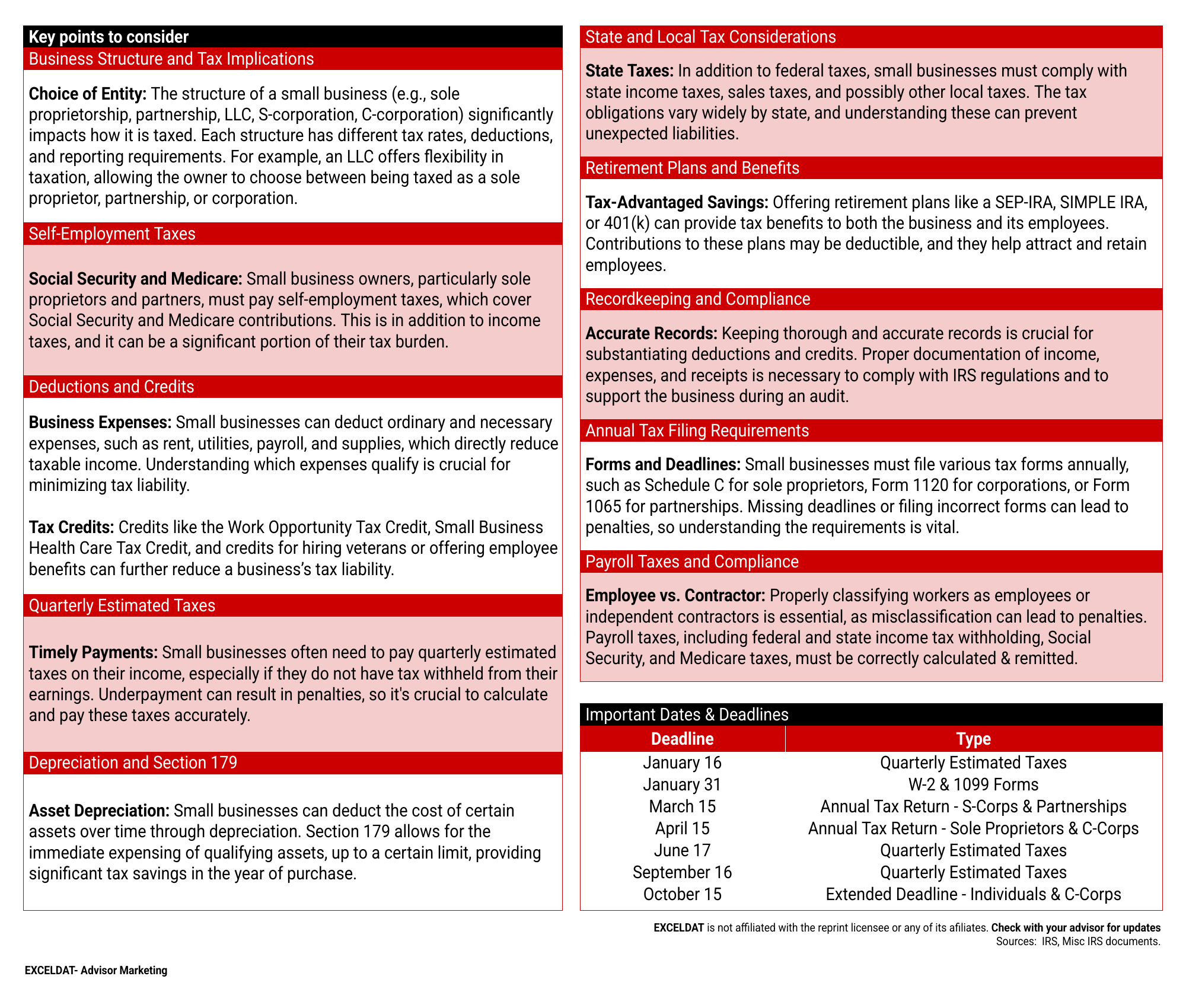

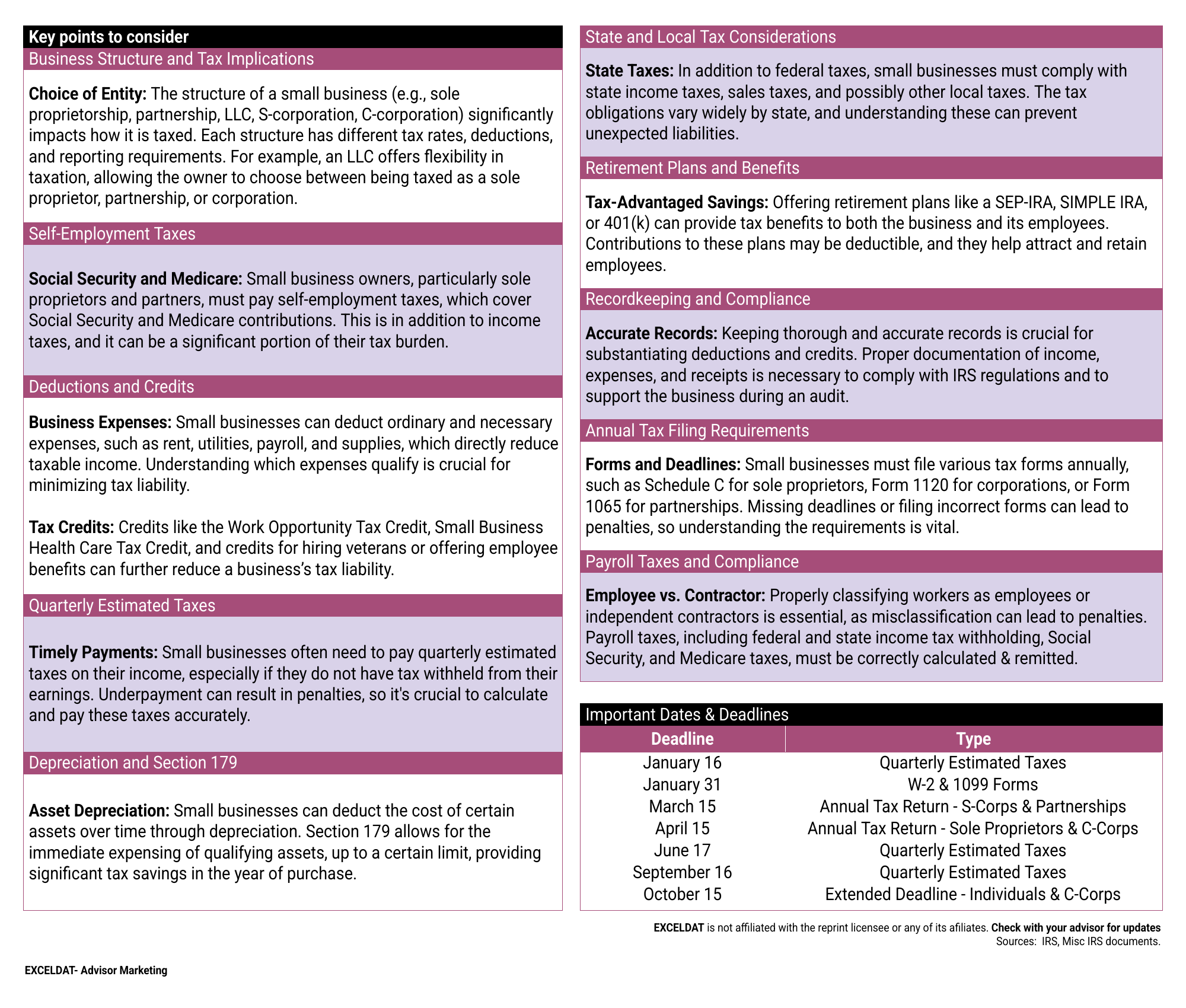

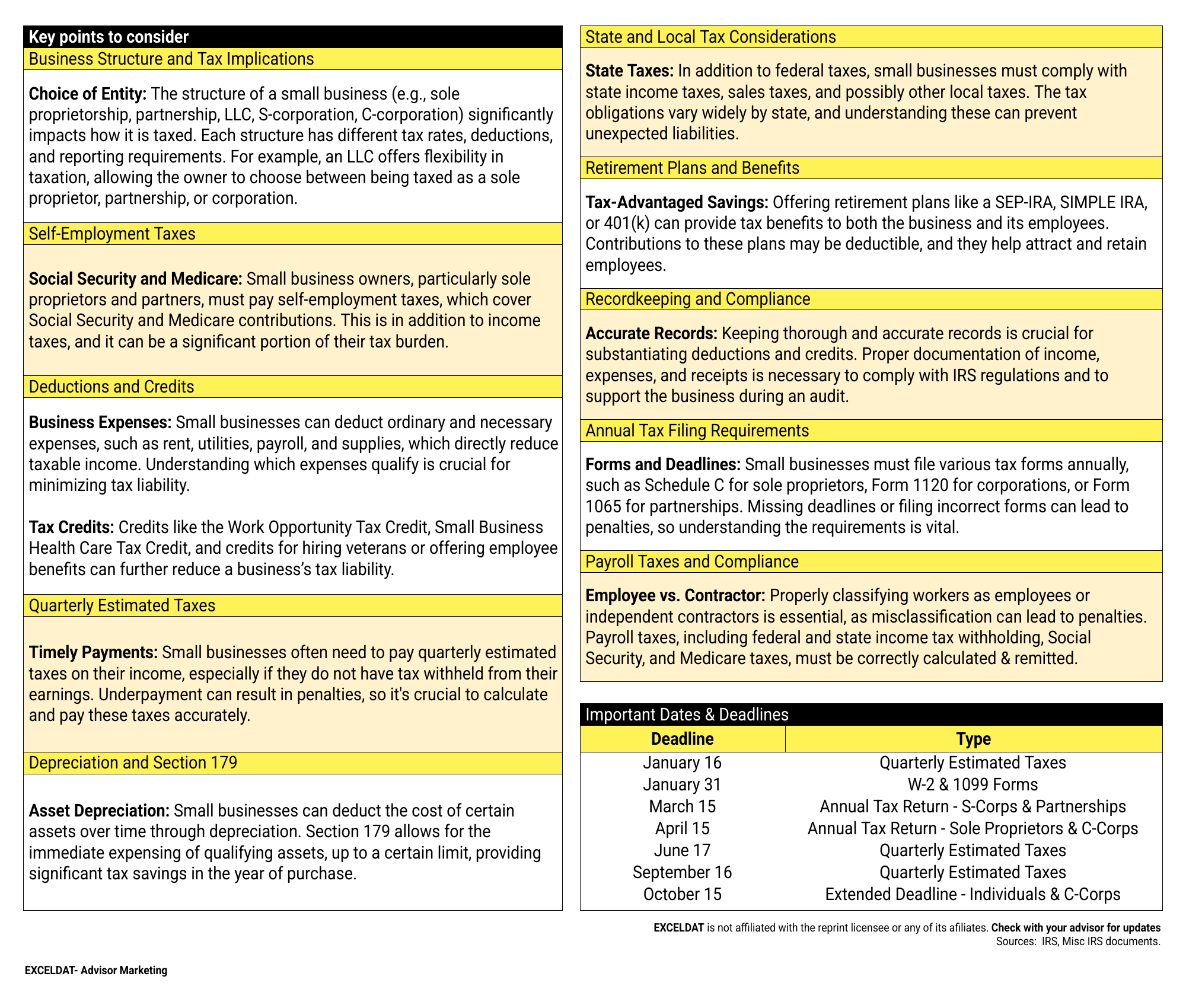

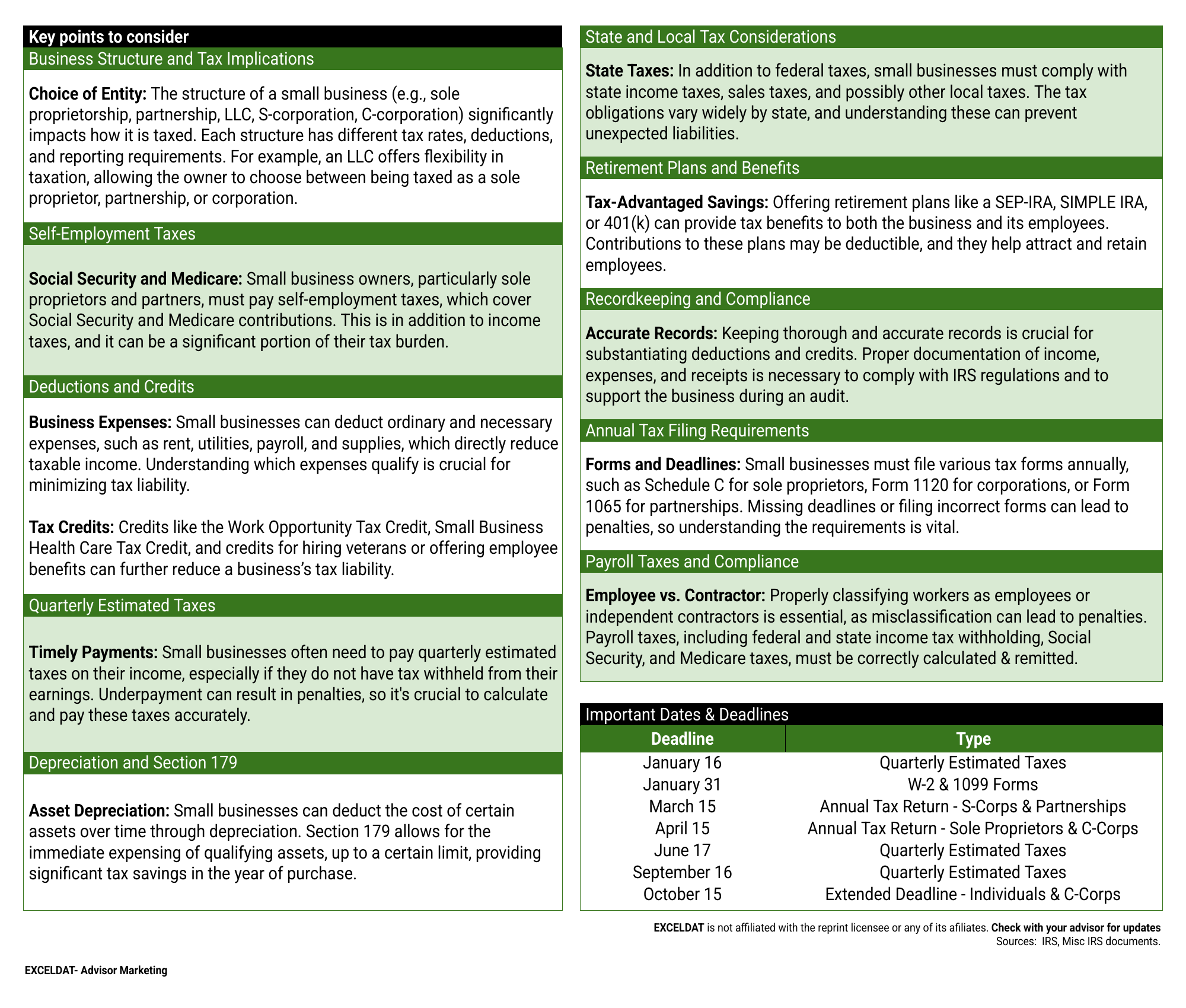

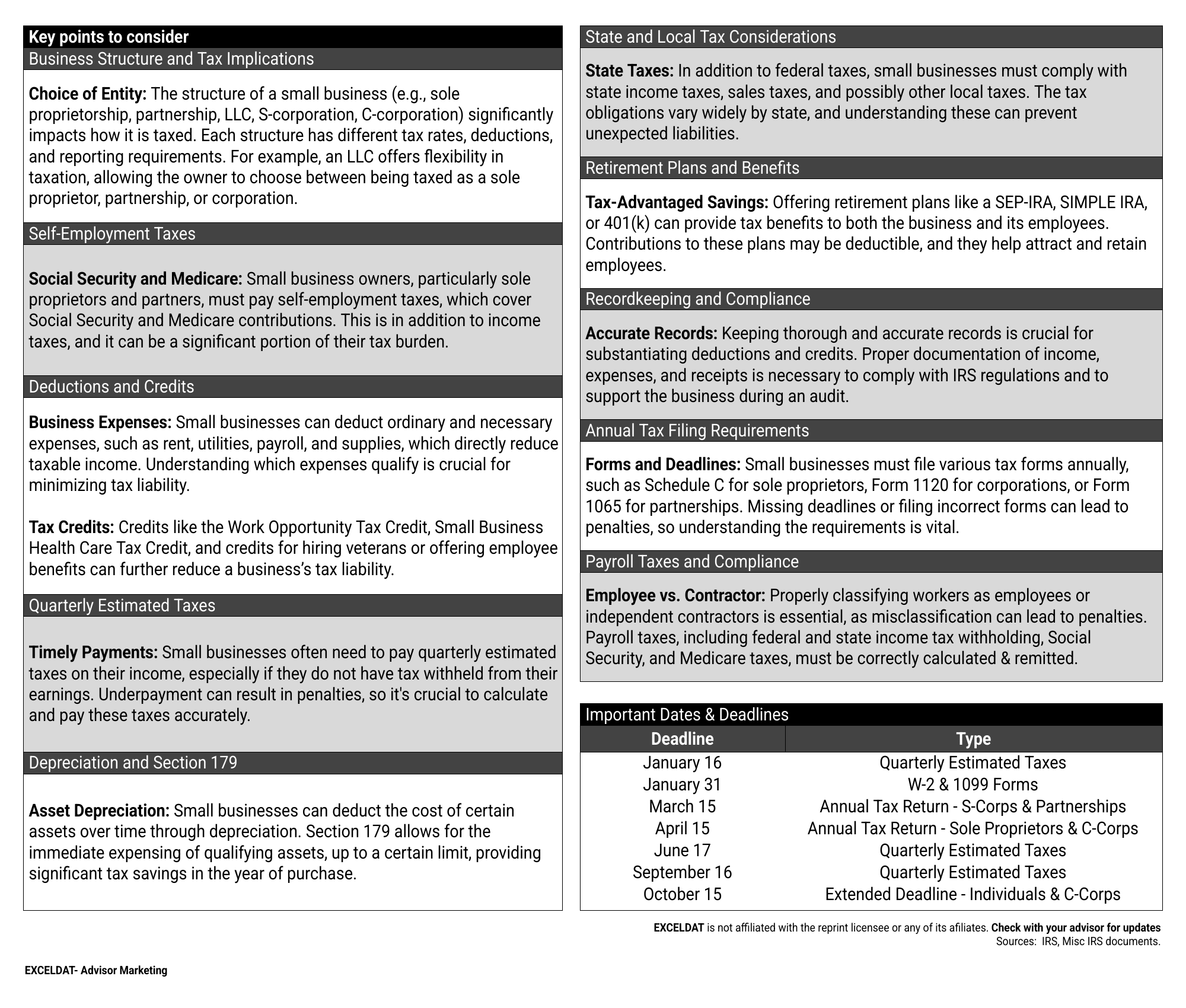

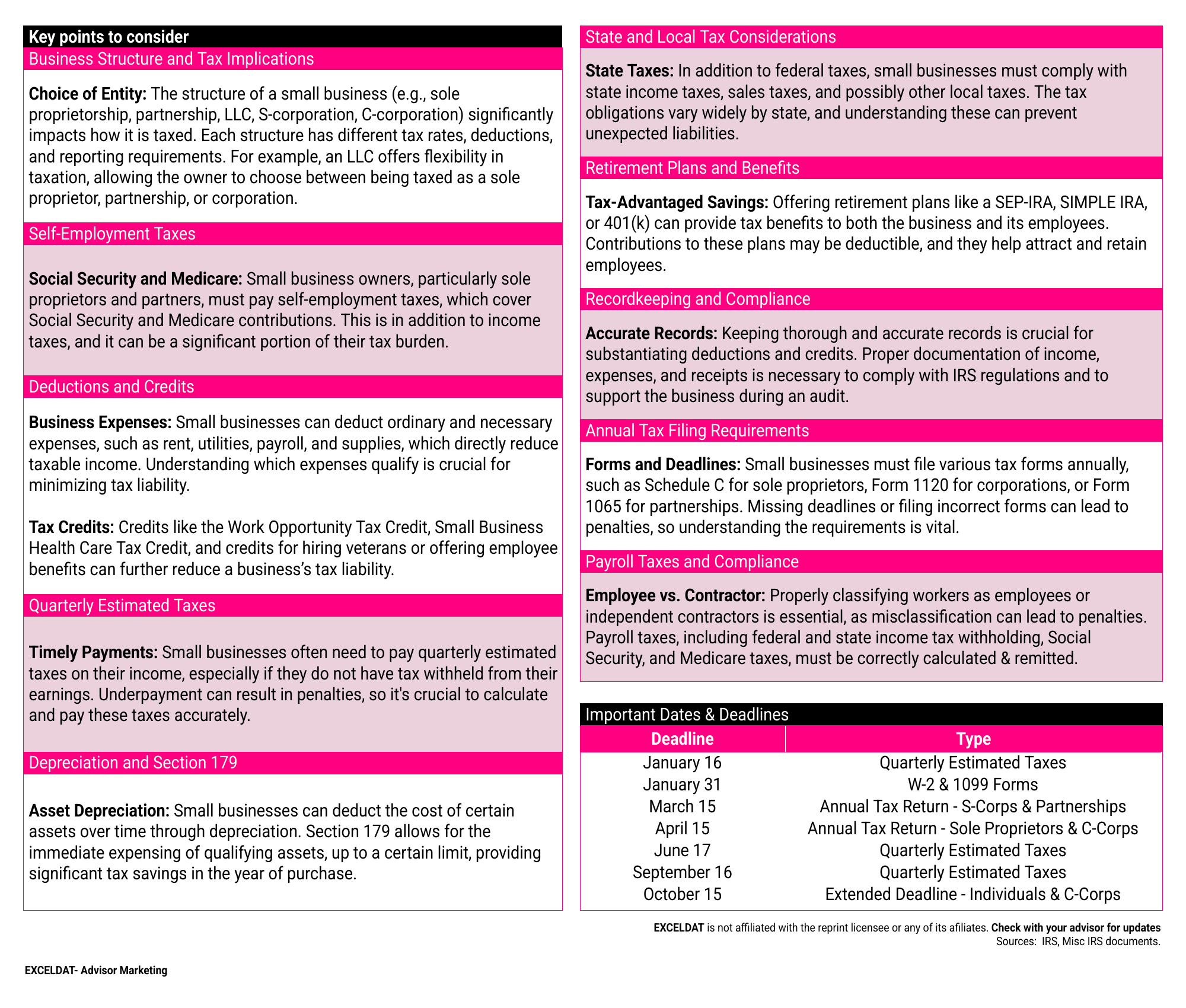

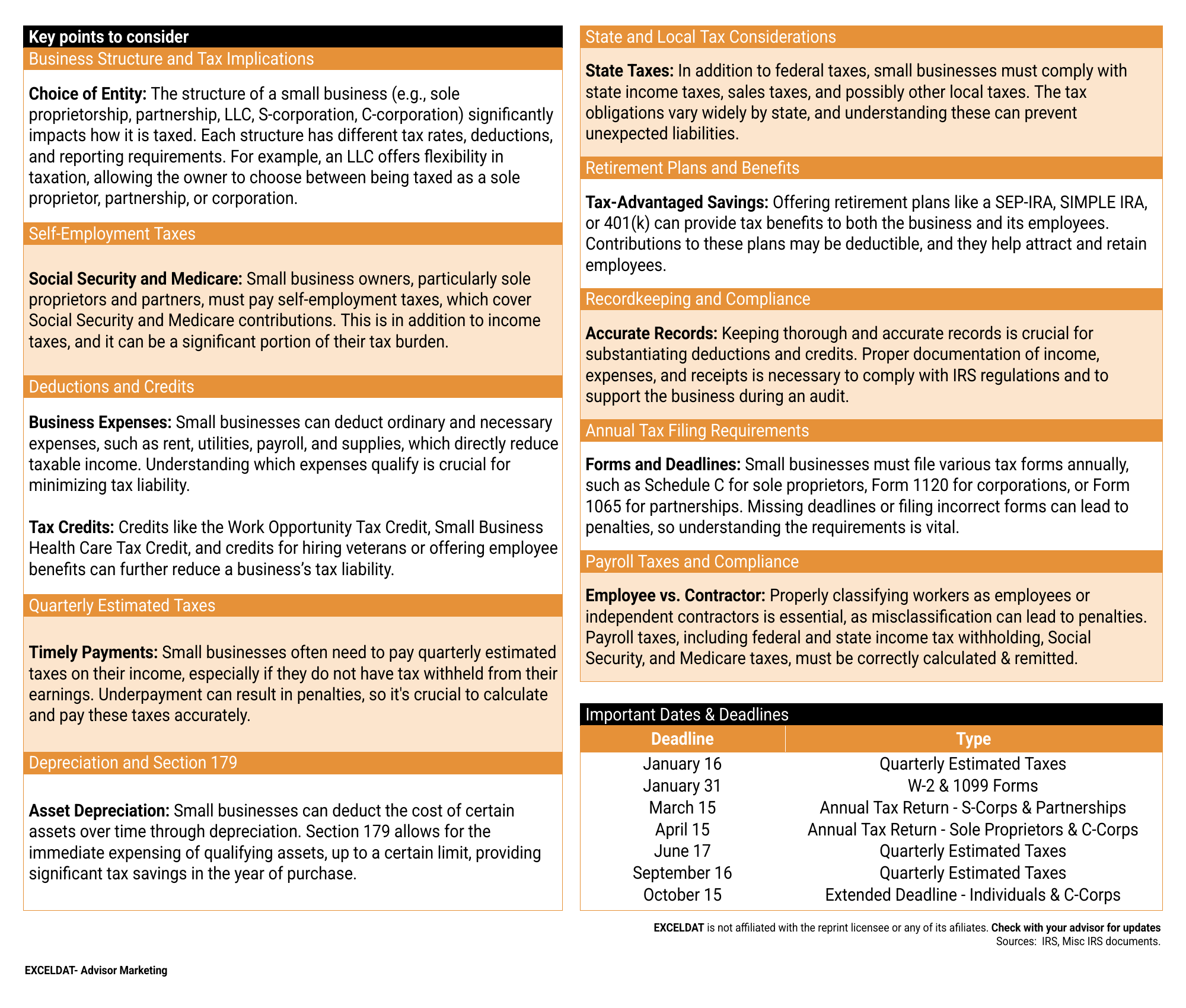

Annual Tax Filing Deadlines

Annual Tax Filing Deadlines

- Lists critical deadlines for:

- Corporations, S-corps, and sole proprietors.

- Estimated tax payments to avoid late penalties.

State and Local Tax Considerations

State and Local Tax Considerations

- Discusses varying tax obligations across states and localities:

- Helps businesses prepare for state-specific regulations.

- Avoids unexpected liabilities with proactive planning.

Why This Material Matters

The 2025 Small Business Tax Essentials equips small business owners with the knowledge to make informed decisions about tax planning and compliance. By emphasizing key dates, deductions, and filing obligations, this resource helps clients prepare for a successful tax season and positions you as a trusted advisor.

Order Your Handout Today

Provide your clients with the tools they need to navigate small business taxes effectively. Get the 2025 Small Business Tax Essentials to ensure compliance, maximize deductions, and plan confidently.

Reviews

There are no reviews yet.