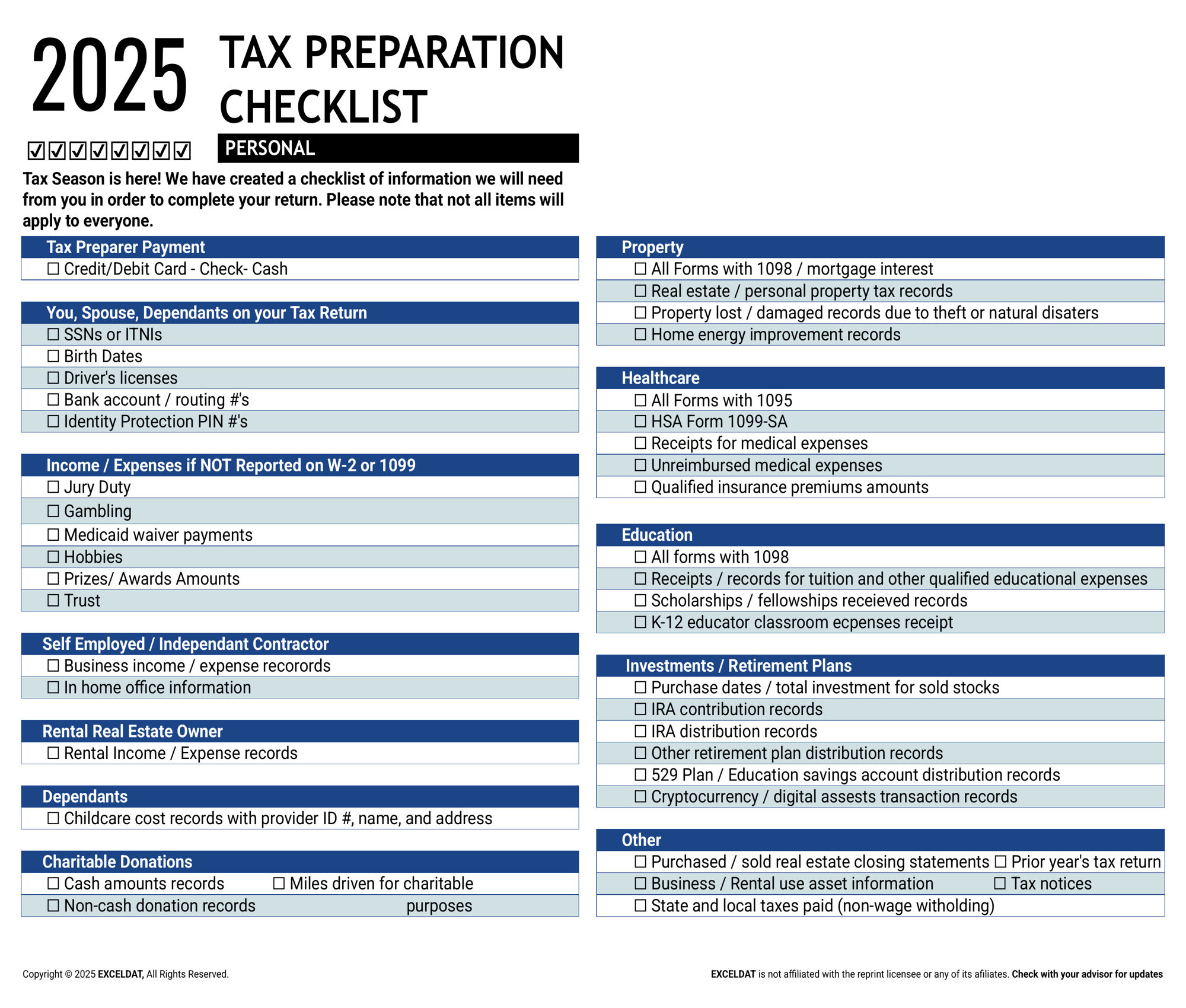

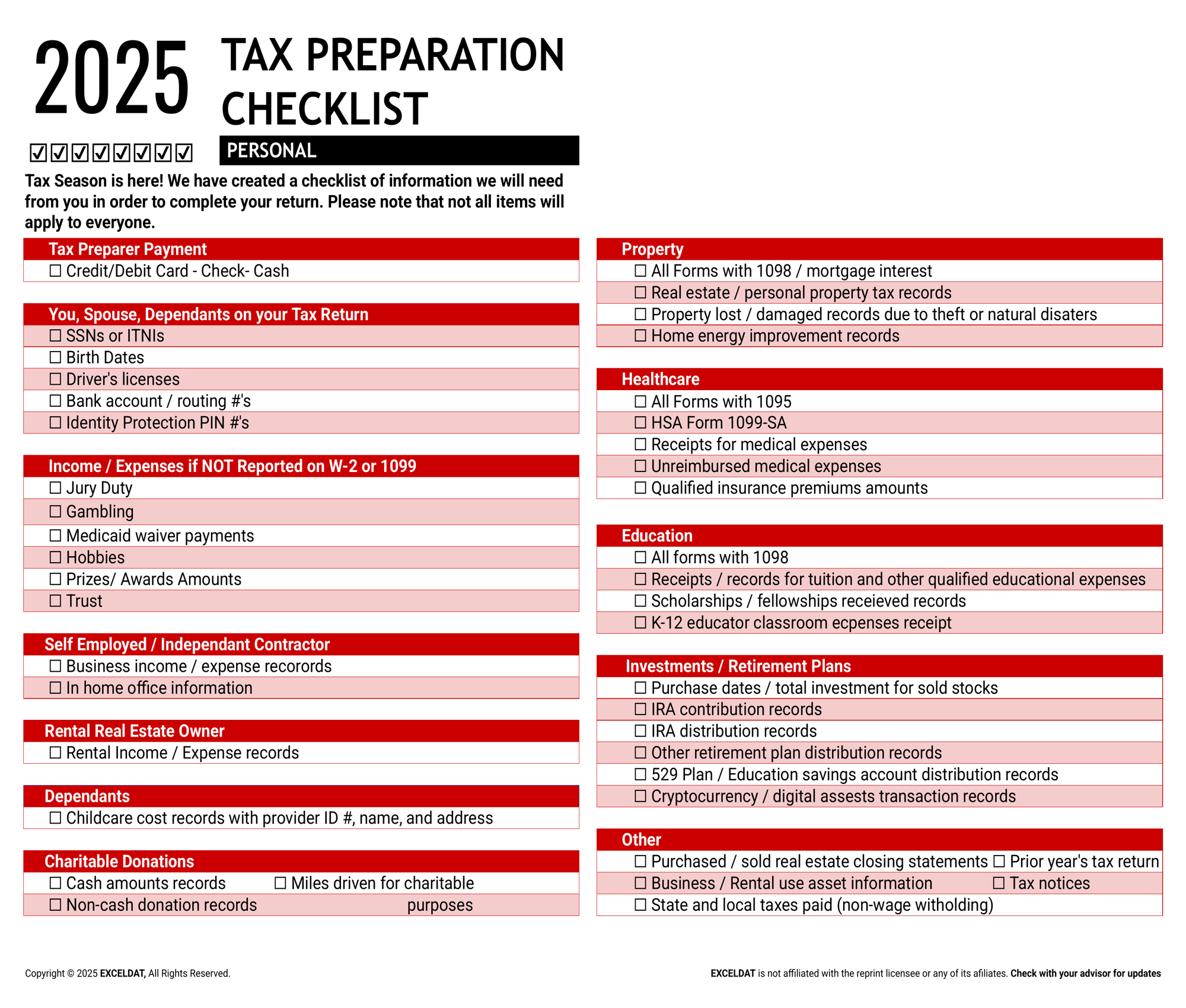

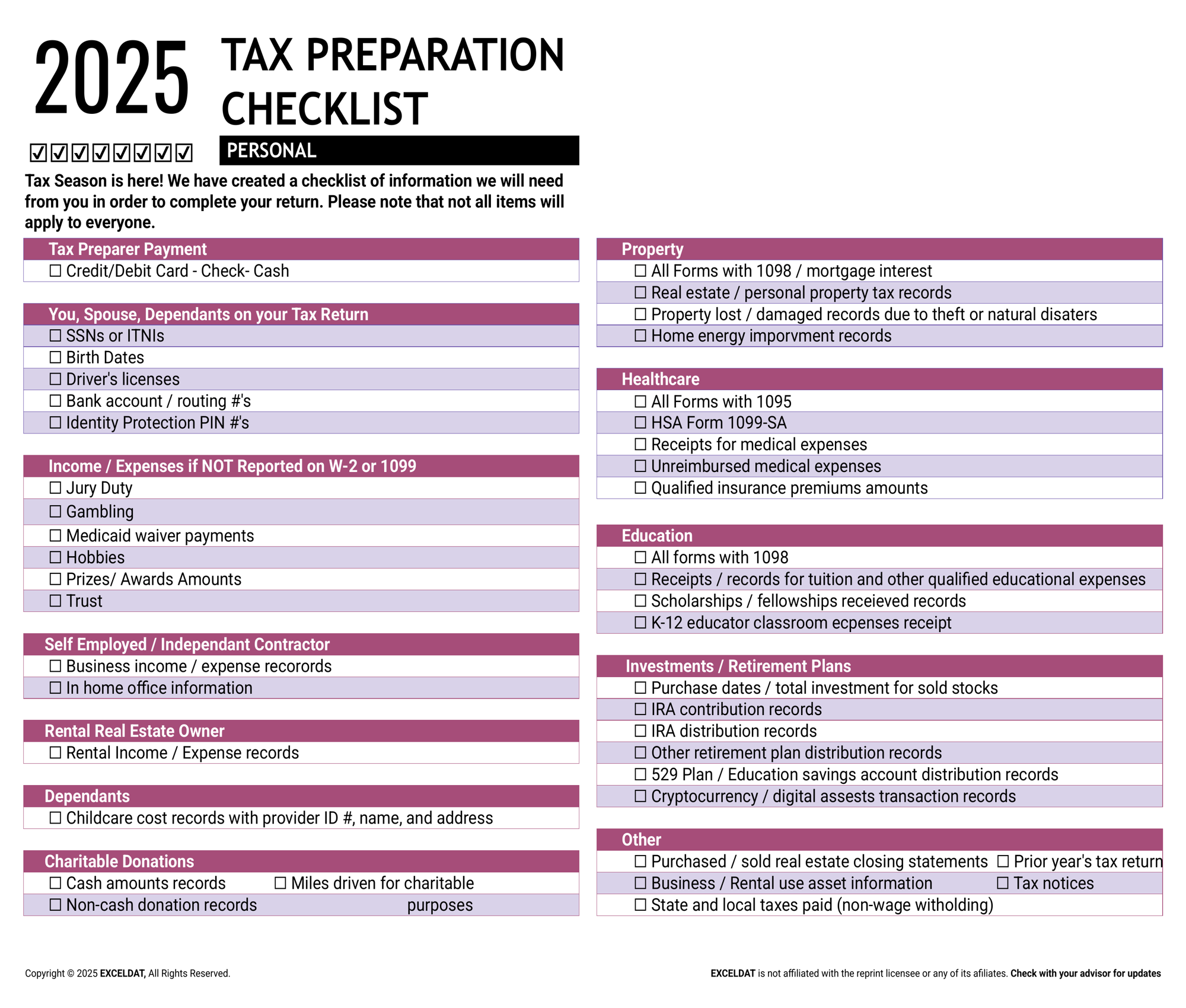

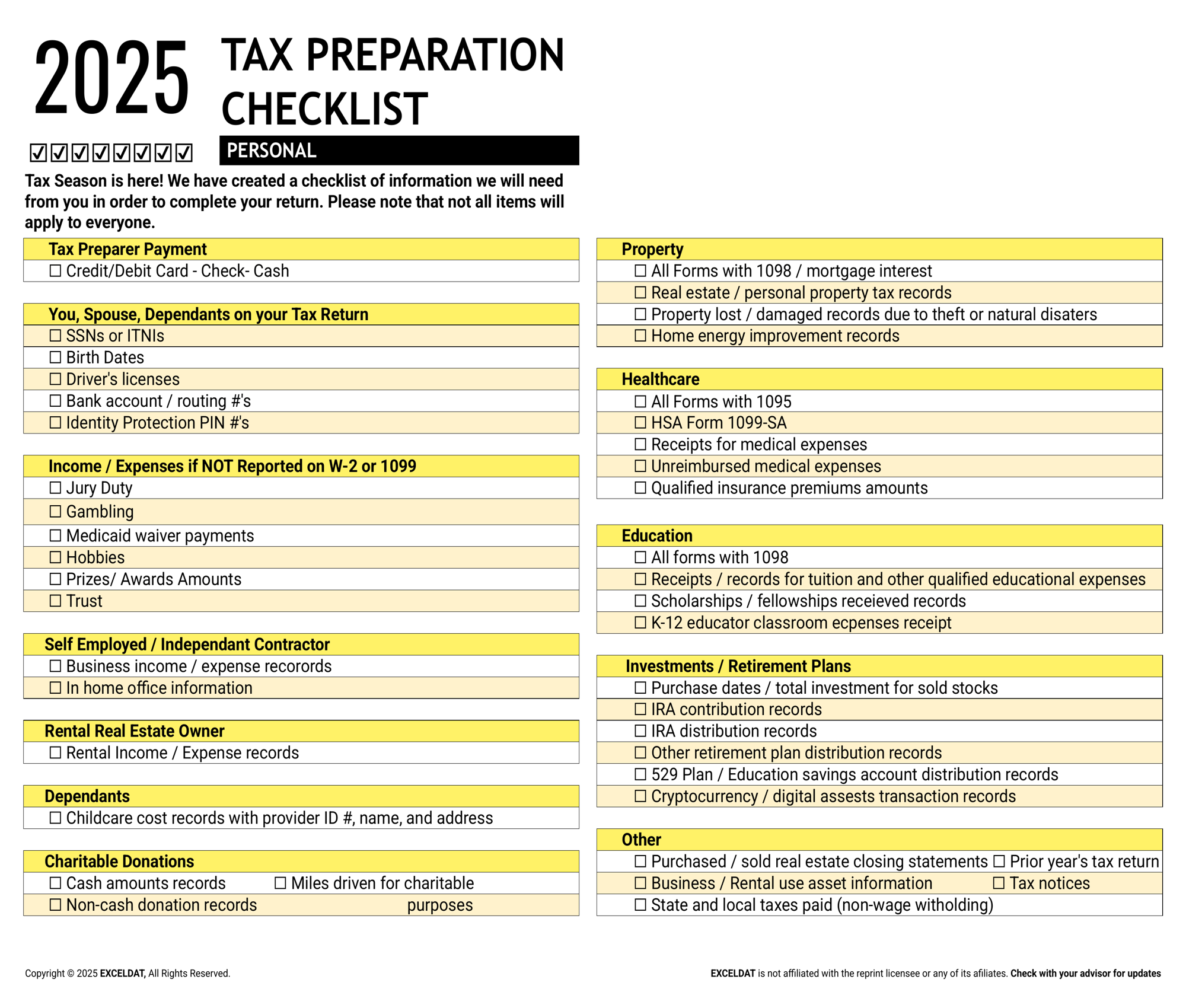

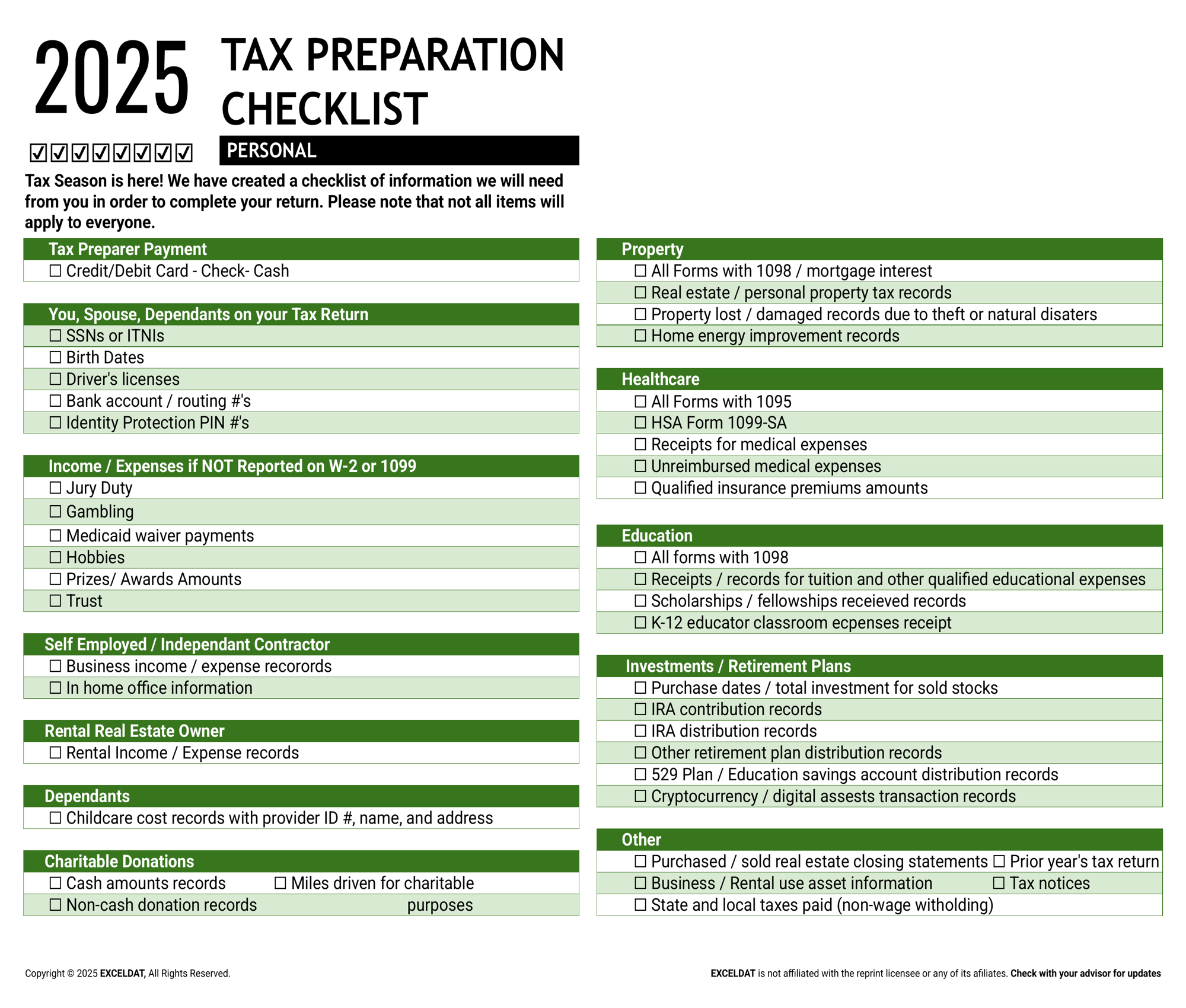

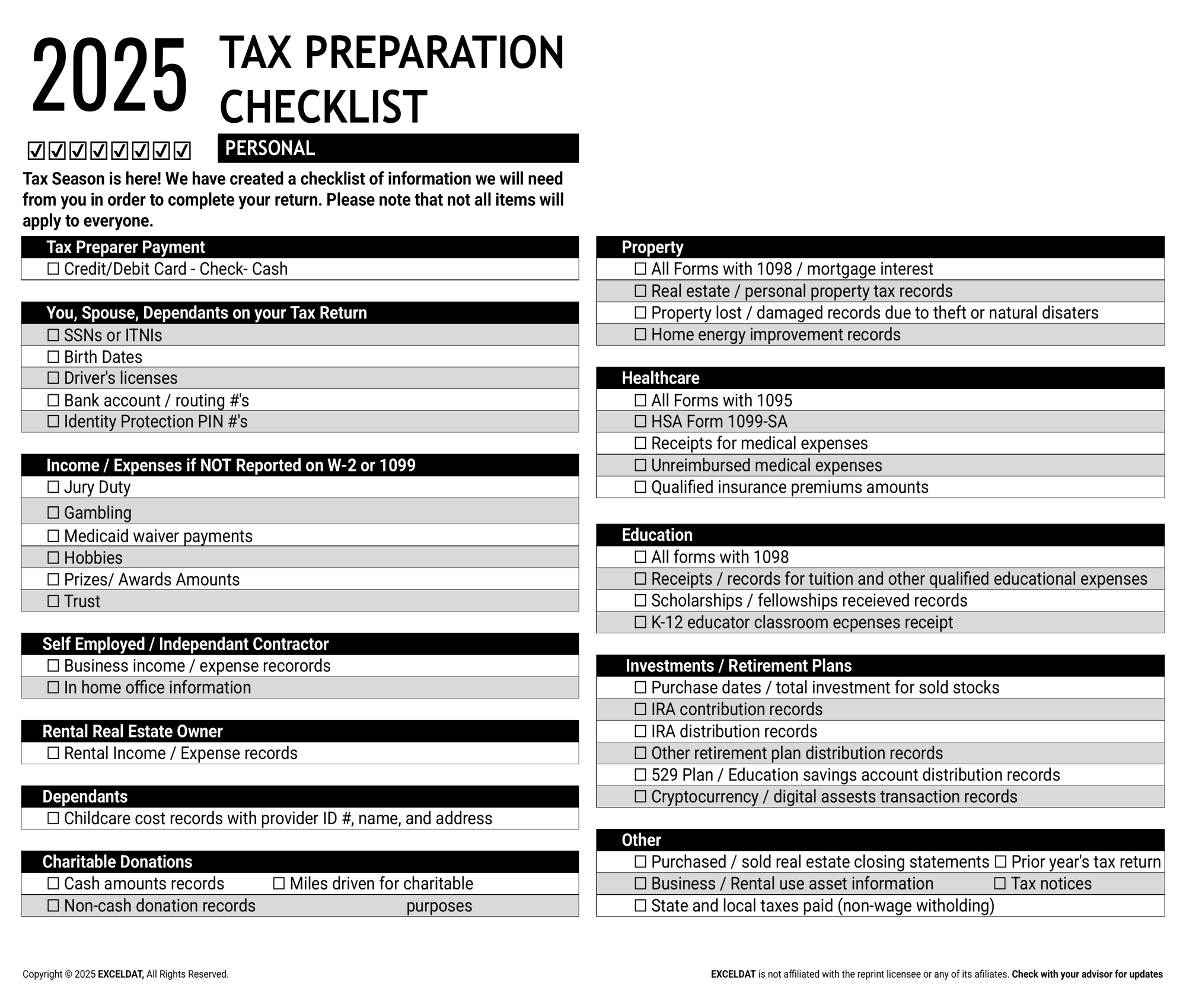

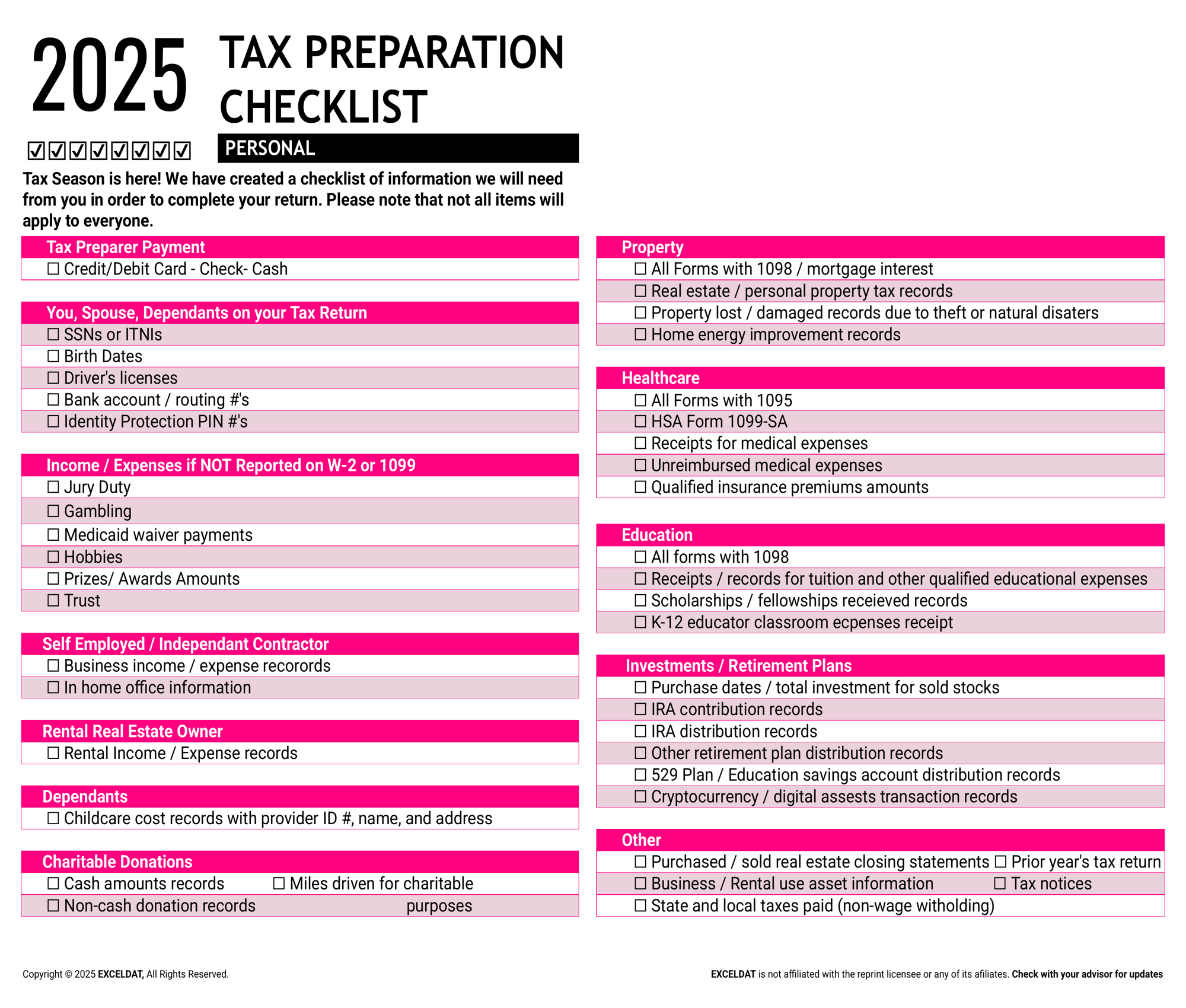

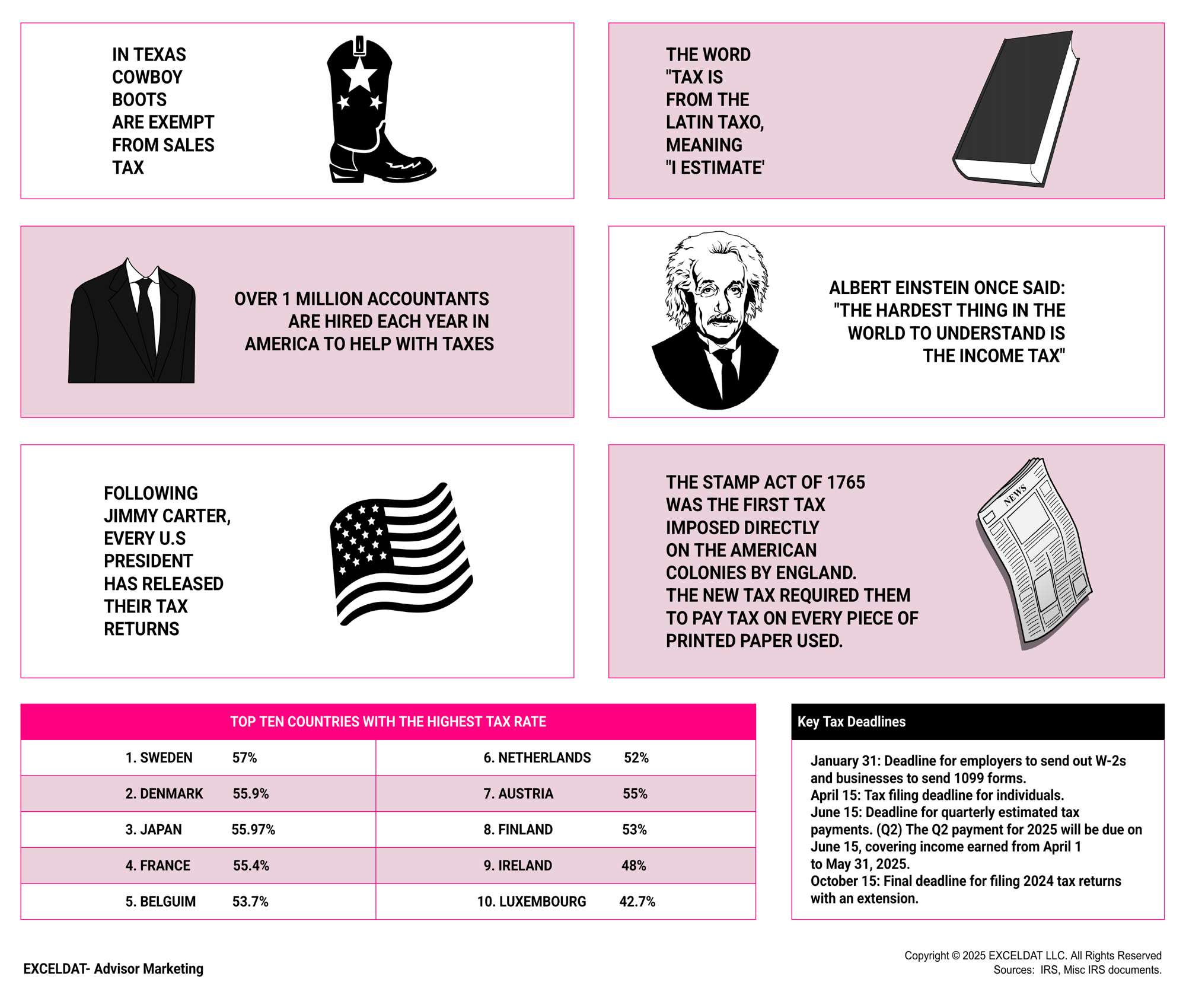

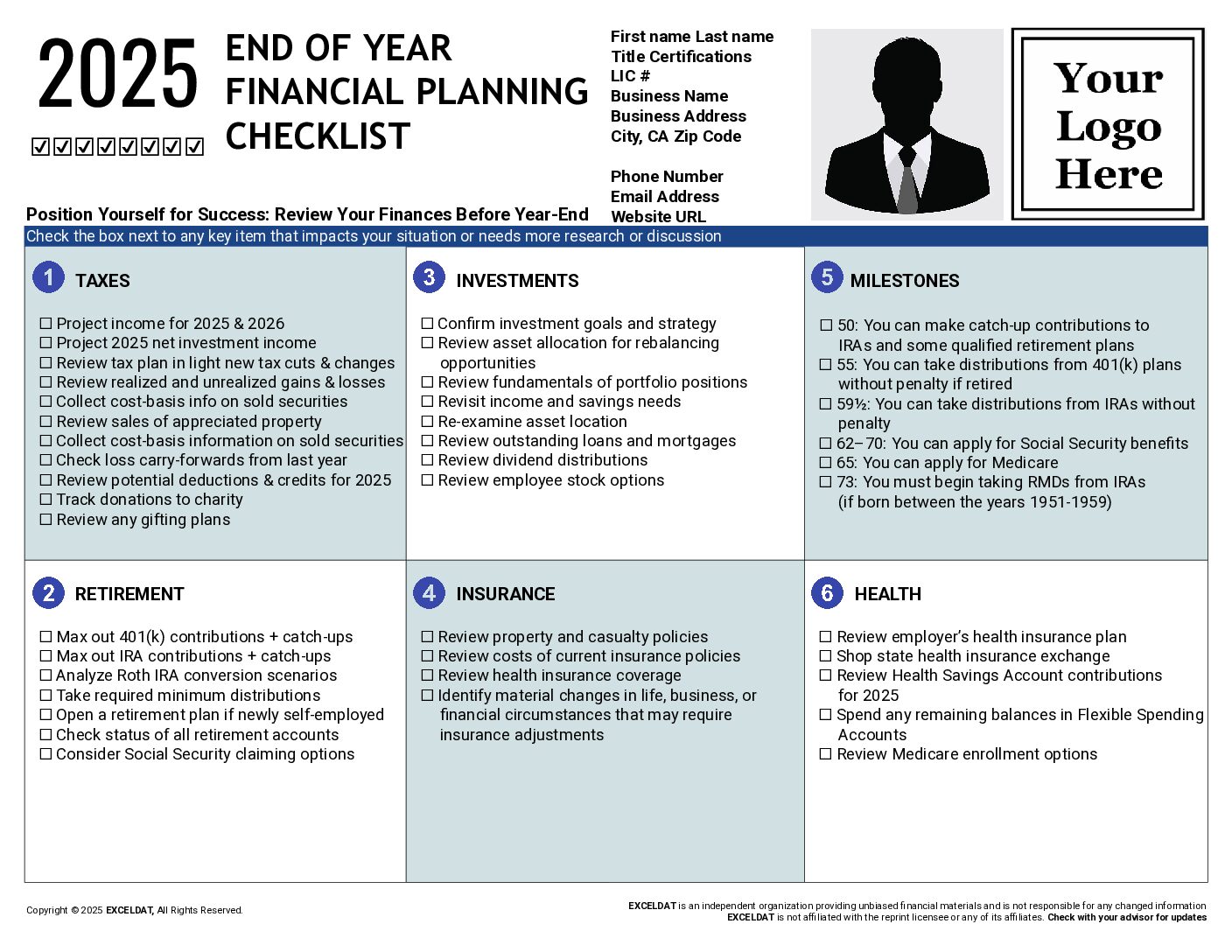

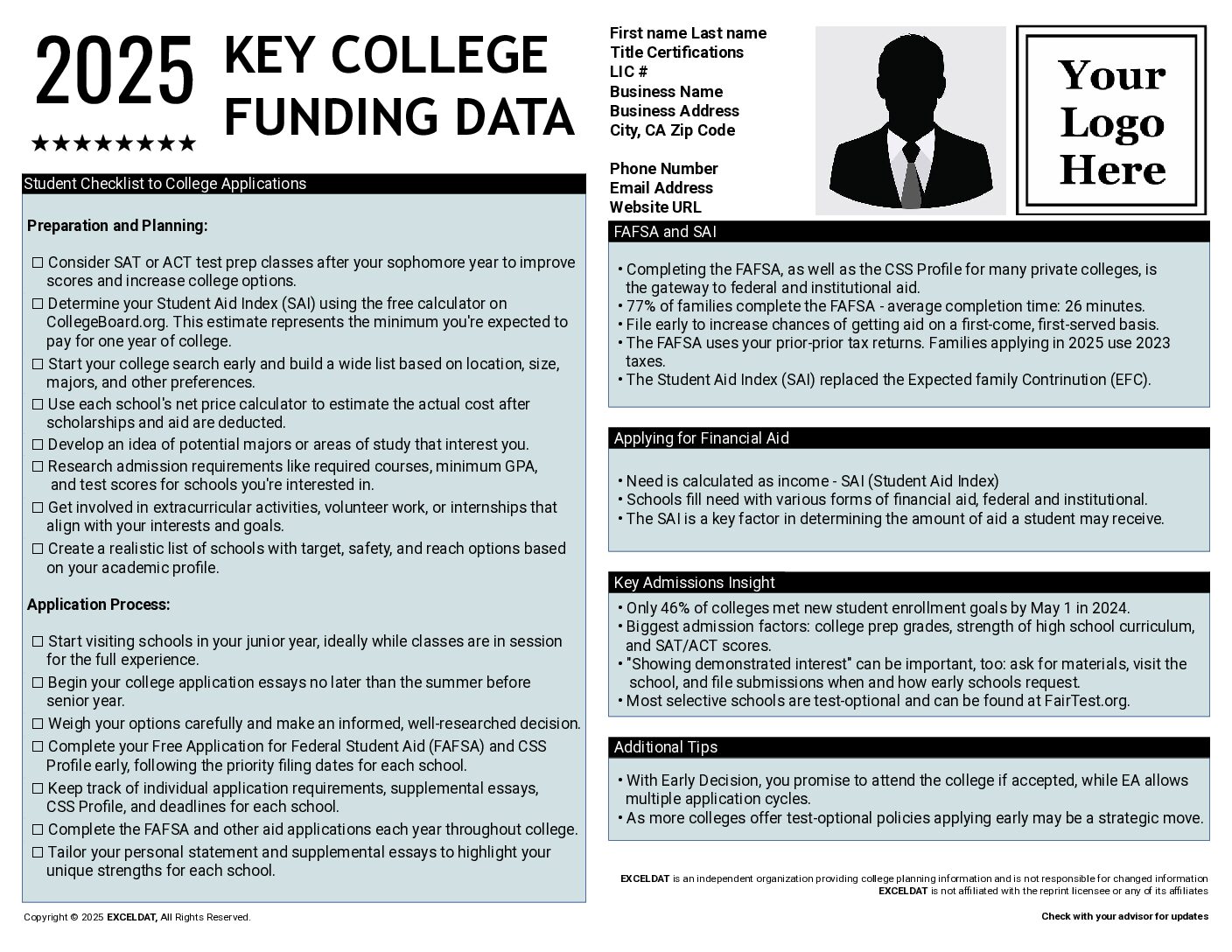

Tax Preparation Checklist: Personal (2025 Edition)

The 2025 Personal Tax Preparation Checklist is your ultimate guide to staying organized during tax season. Designed for individuals and tax professionals, this comprehensive resource ensures all necessary documentation is gathered for accurate and timely tax filings, minimizing errors and ensuring compliance.

Personal Information and Dependents

Personal Information and Dependents

- Helps clients provide essential details, including names, birth dates, SSNs, and identity protection PINs.

- Ensures tax returns are completed accurately and without delays.

Income and Expense Reporting

Income and Expense Reporting

- Covers income sources beyond W-2s and 1099s, such as:

- Independent contractor earnings.

- Self-employed income.

- Rental property income.

- Investment gains or losses.

- Ensures complete and accurate reporting of financial activities.

Healthcare and Medical Expenses

Healthcare and Medical Expenses

- Guides clients in gathering:

- HSA forms and 1099-SAs.

- Receipts for unreimbursed medical expenses and insurance premiums.

- Helps apply qualified deductions effectively.

Property and Charitable Contributions

Property and Charitable Contributions

- Covers documentation for property taxes, real estate expenses, and charitable donations.

- Includes deductions for mortgage interest, charitable miles driven, and property damage from theft or natural disasters.

Education and Retirement

Education and Retirement

- Guides on collecting documentation for:

- Education-related expenses (scholarships, fellowships, educator expenses).

- Retirement contributions and distributions from IRAs and 529 plans.

Business and Rental Real Estate

Business and Rental Real Estate

- Tailored sections for business owners and rental property investors:

- Compile income and expense records.

- Track asset purchases and office use details.

- Ensure eligibility for deductions and tax credits.

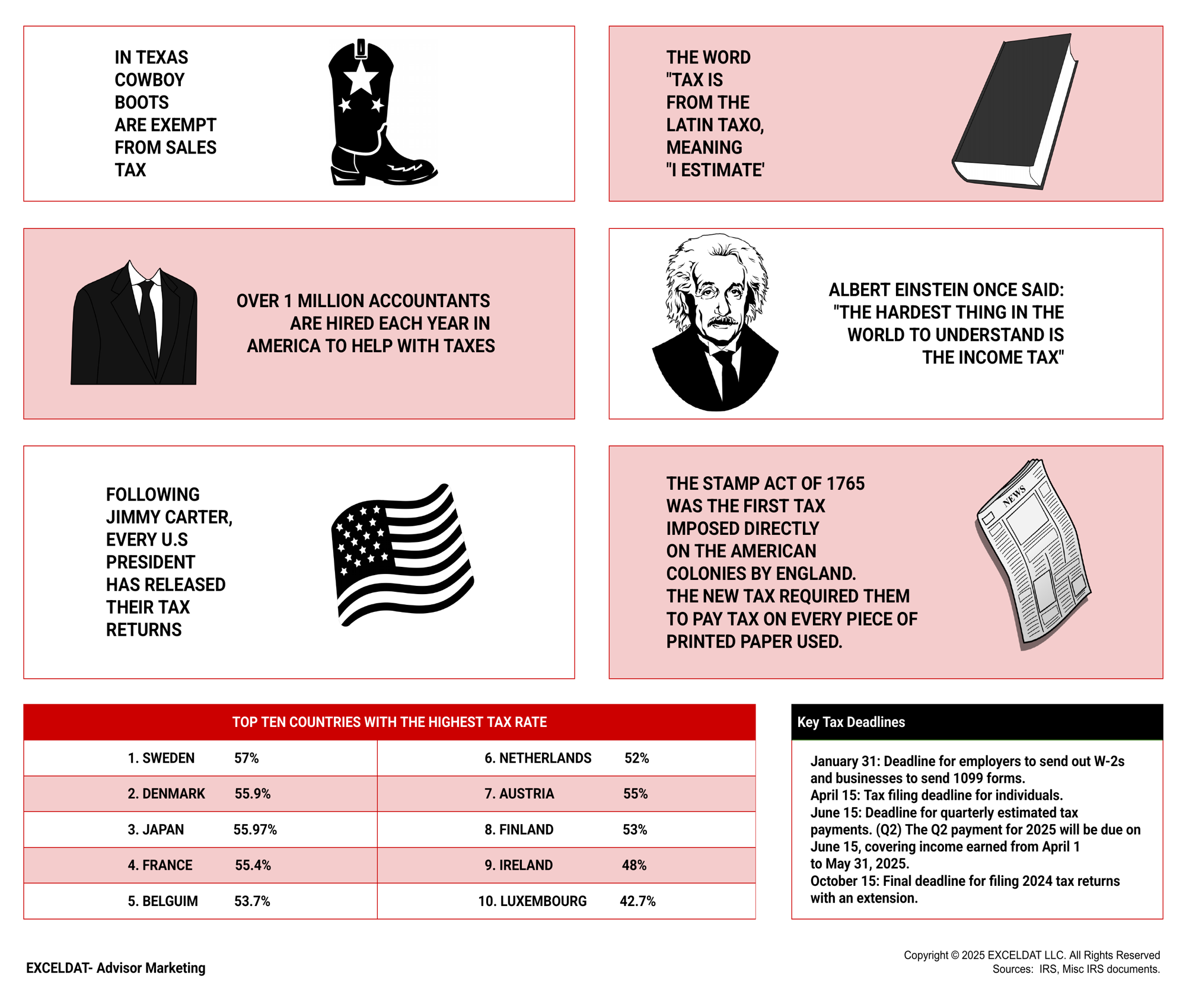

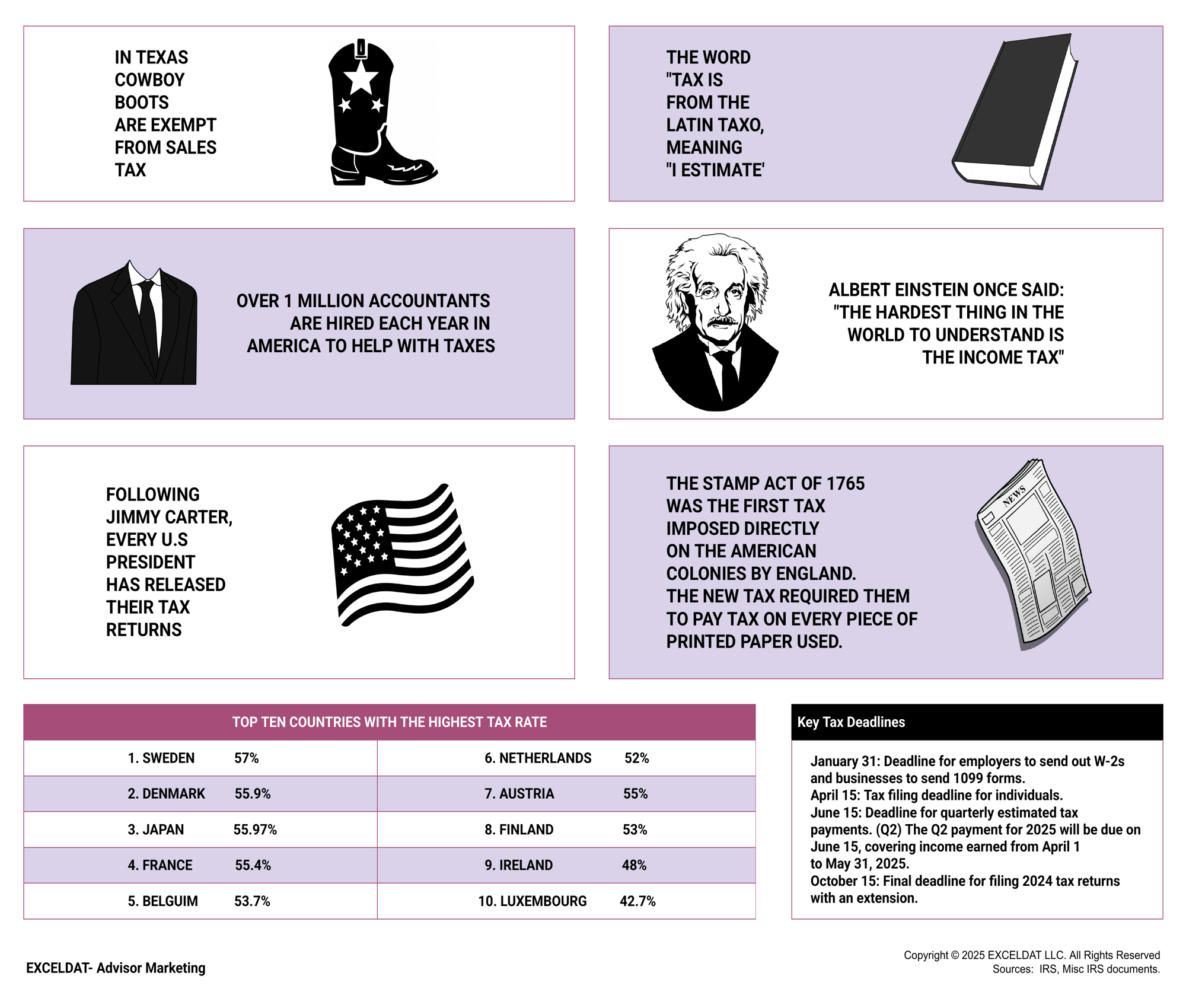

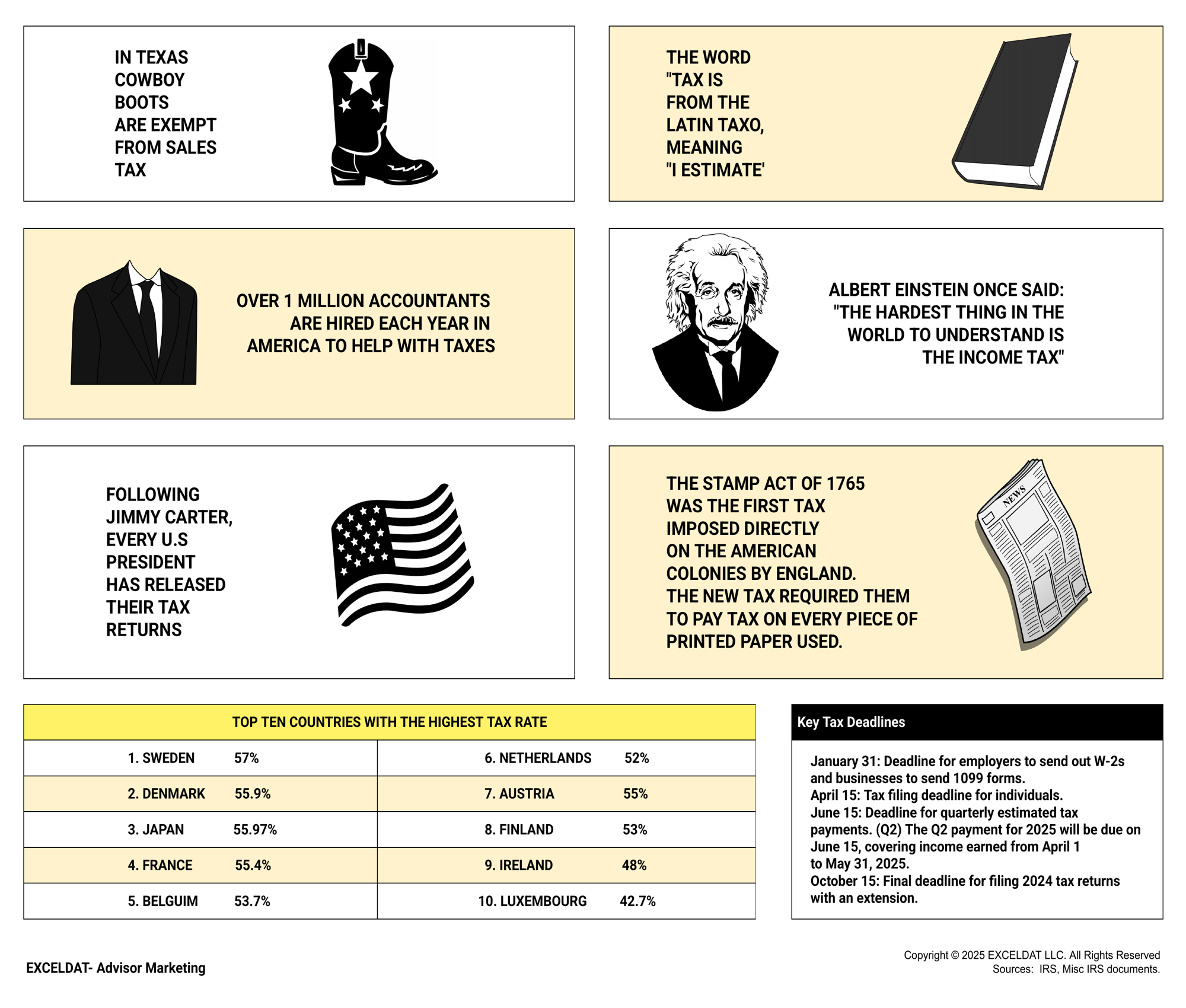

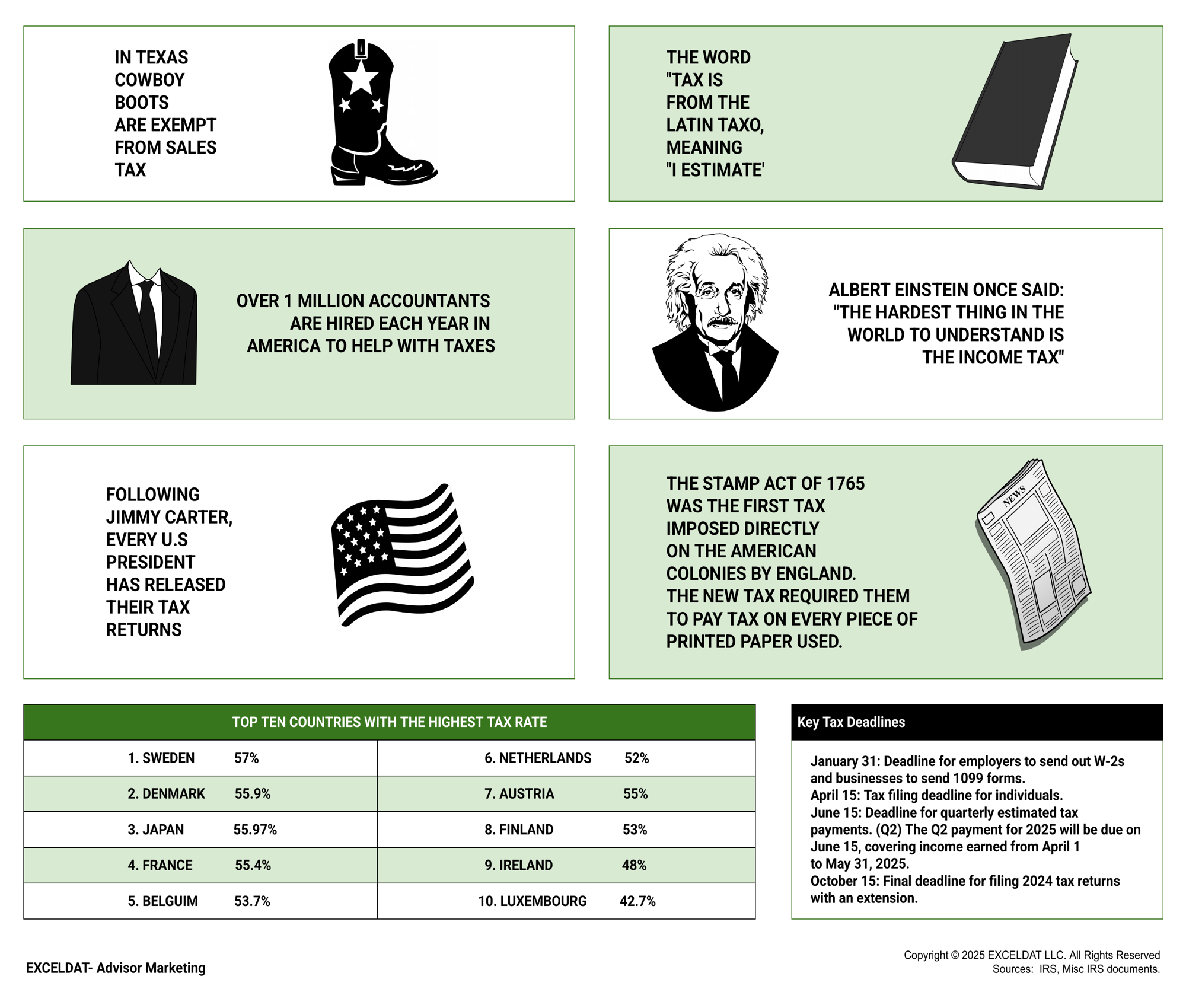

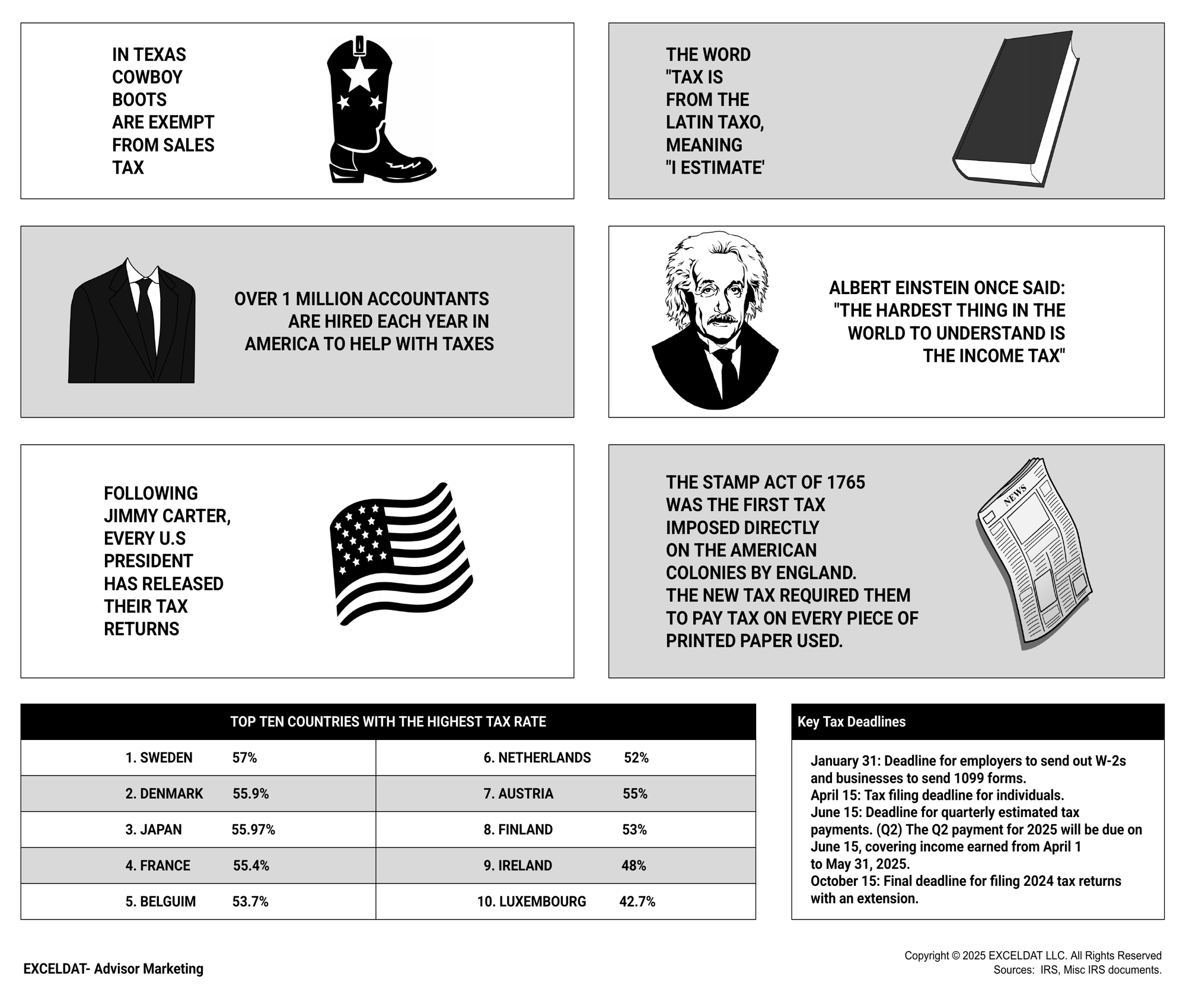

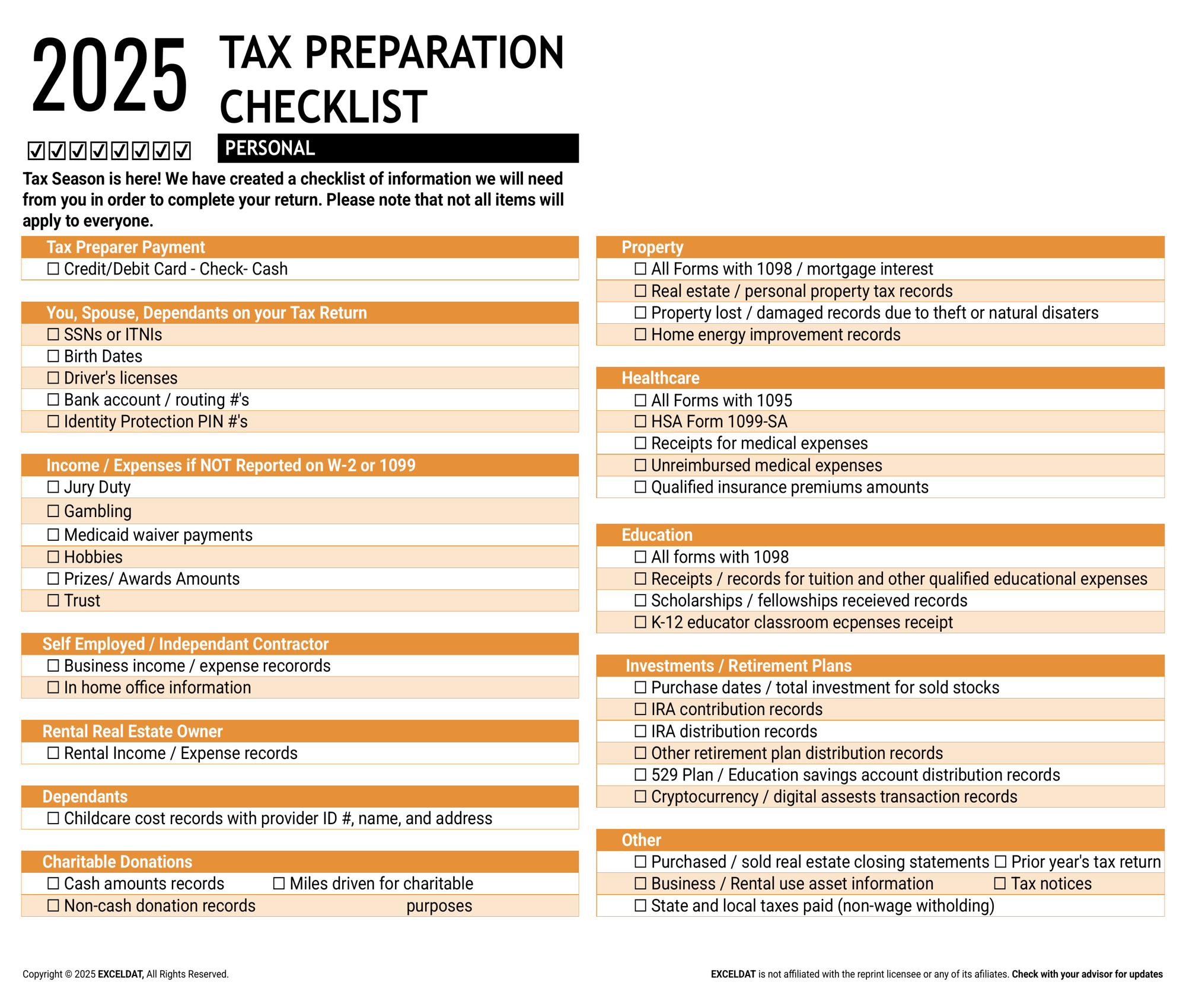

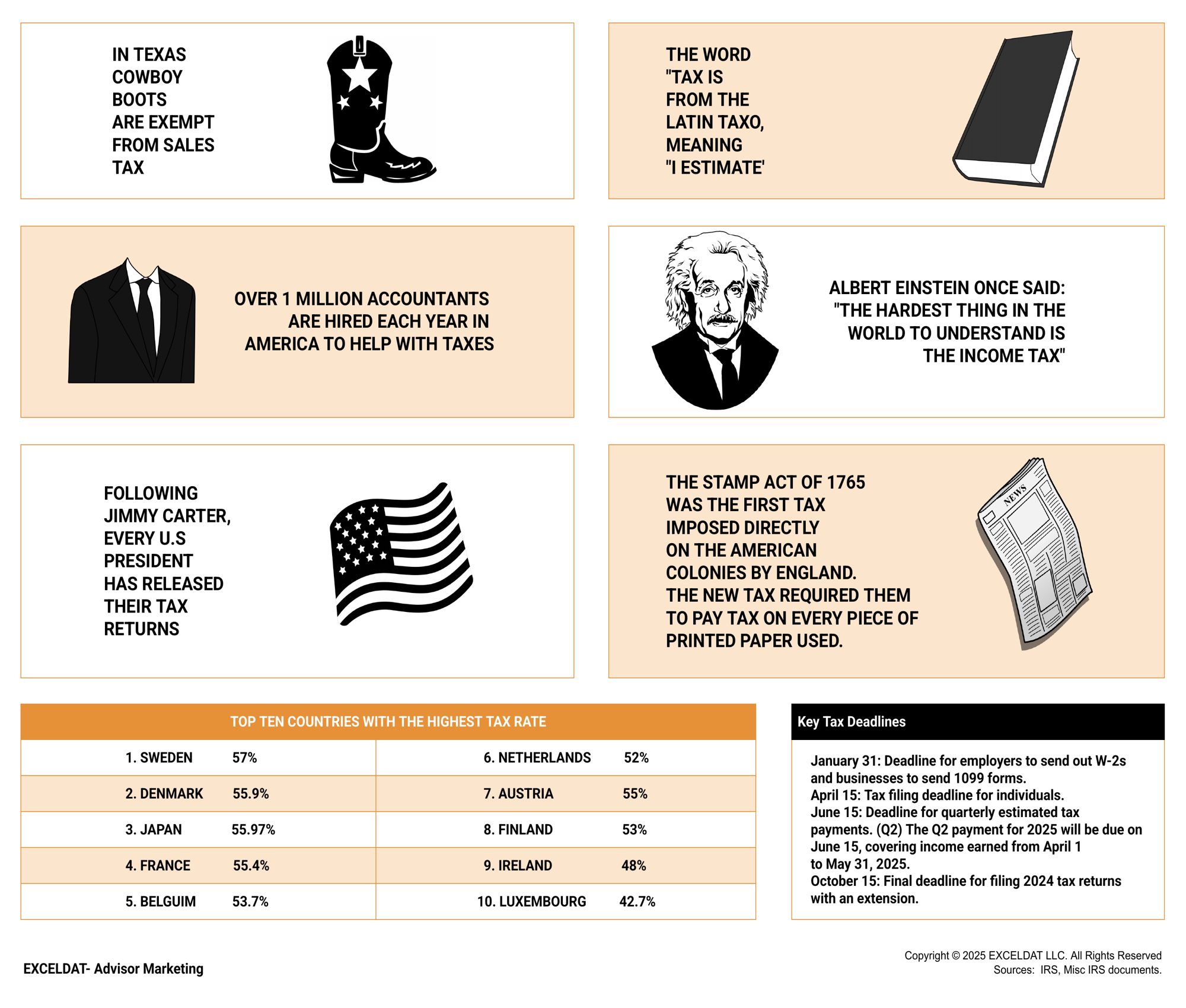

Key Dates and Deadlines

- When Employers must send out W-2s and 1099 forms.

- Tax filing deadline for individuals.

- Deadline for quarterly estimated tax payments.

- Final deadline for extended tax filings.

Why This Checklist Matters

The 2025 Personal Tax Preparation Checklist ensures clients are well-prepared for tax season. With all the necessary documentation in hand, this tool facilitates a smooth and timely tax filing process, making it indispensable for tax professionals seeking to provide organized and thorough services.

Order Your Checklist Today

Help clients stay on top of their taxes with the 2025 Personal Tax Preparation Checklist. Equip yourself with the resources to ensure accurate filings and peace of mind.

Reviews

There are no reviews yet.